"The grass withers, the flower fades, but the word of our God stands forever" Isaiah 40:8

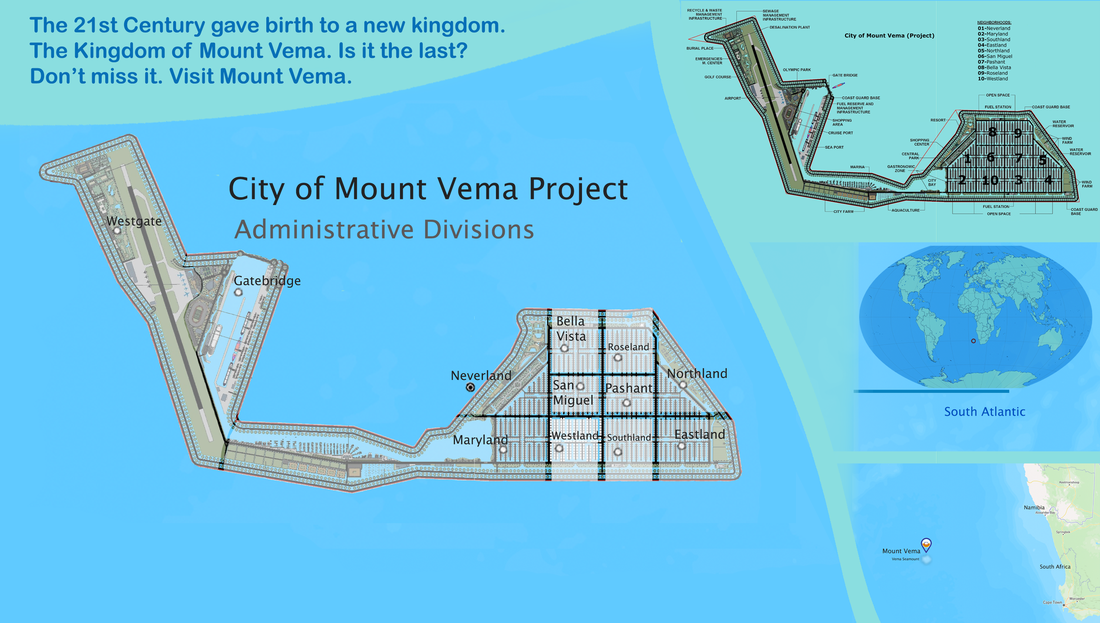

MOUNT VEMA

Home | Contact | News | Banking | Currency | Shopping | Travel | Jobs | Real Estate | Weather | Search | 912 Emergencies | LOG IN

The Legal Entities of Mount Vema

|

COUNTRY

|

COUNTRY CODE

COUNTRY CODES IN USE Mount Vema Country Code: OV / MOV Mount Vema Numeric Country Code: 507 Currency Code: VSG Top-Level Domain: .com, and .ov (proposed) Proposed Telephone Country Code: +294 |

|

International Treaties – Ratified by the Kingdom of Mount Vema

Law of the Sea Treaty (United Nations Convention on the Law of the Sea) MARPOL 73/78 (Convention for the Prevention of Pollution from Ships) The Vienna Convention on Diplomatic Relations of 1961 The Vienna Convention on Consular Relations 1963 |

State Alert! – Security, Public Safety and Emergencies

YELLOW WARNING official advise to be aware. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>