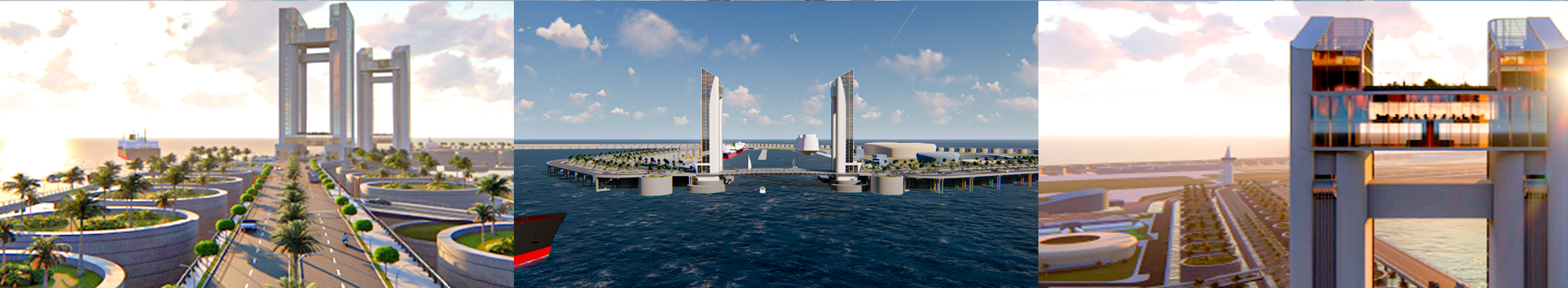

BANK OF MOUNT VEMA

THE CENTRAL BANK OF THE KINGDOM OF MOUNT VEMA

The Bank of Mount Vema is an institution of the Crown of the State. The Central Bank of the Kingdom of Mount Vema, and an agency of the Royal Mount Vema Reserve Bank. The Bank is the Monetary Authority of the Kingdom of Mount Vema, and is responsible for issuing bank notes and general management of the currency.

|

Central Bank Interest Rate: 3.45%

As the Central Bank of Mount Vema we are charged with quasi-regulatory responsibilities, such as supervising commercial banks, and controlling the currency of the territory, money supply, interest rates, and to oversee the commercial banking system. We also act as a "lender of last resort" to the banking sector during times of financial crisis. Therefore, we are an entity institutionally designed to be independent from political interference.

|

|

Functions of the Bank of Mount Vema include:

- implementing monetary policies

- setting the official interest rate – to manage both inflation and the exchange rate of the territory – and ensuring that this rate takes effect via a variety of policy mechanisms

- controlling the nation's entire money supply

- the Government's banker and the bankers' bank (""lender of last resort")

- managing the country's foreign exchange and the Government's stock register

- regulating and supervising the banking industry

Types of Mount Vema bank

- Commercial banks: bank that mostly deals with deposits and loans from corporations or large businesses.

- Credit unions or co-operative banks: not-for-profit cooperatives owned by the depositors and often offering rates more favourable than for-profit banks. Typically, membership is restricted to employees of a particular company, residents of a defined area, members of a certain union or religious organizations, and their immediate families.

- Private banks: banks that manage the assets of high-net-worth individuals.

- Retail Bank and Building societies: institutions that conduct retail banking.

- A direct or internet-only bank: is a banking operation without any physical bank branches. Transactions are usually accomplished using ATMs and electronic transfers and direct deposits through an online interface.

- Acquiring Bank: processes credit or debit card payments on behalf of merchants, and allows merchants to accept credit card payments from card-issuing banks.

BANK LICENSE - How to Apply

To apply for a Mount Vema banking license you must submit a letter of Expression of Interest to the attention of the Banking License Officer. Once your letter is received, you will receive a formal invitation with the application form.

|

Types of banking services Banks' activities are divided into:

|

Requirements for the issue of a Bank License The requirements for the issue of a Mount Vema bank license vary but typically include:

|

|

Currency Issuance Similar to commercial banks, the Bank of Mount Vema hold assets (government bonds, foreign exchange, gold, and other financial assets) and incur liabilities (currency outstanding). The Bank of Mount Vema creates money by issuing interest-free currency notes and selling them to the public (government) in exchange for interest-bearing assets such as government bonds. When the Bank of Mount Vema wishes to purchase more bonds than His Mount Vema Majesty’s Government make available, it may purchase private bonds or assets denominated in foreign currencies. |

Interest Income Although, an agency of the Reserve Bank, the Bank of Mount Vema, does not remits its interest income to the Reserve Bank, it remits to the Treasury of His Mount Vema Majesty’s Government. This income, derived from the power to issue currency, is internationally referred to as seigniorage, and usually belongs to the national government. The state-sanctioned power to create currency is internationally called the Right of Issuance. |

Price Stability

The Bank of Mount Vema also works to manage inflation. Additional information will be made available here.

The Bank of Mount Vema also works to manage inflation. Additional information will be made available here.

|

| ||||||||||||

|

| ||||||||||||||||||

No weapon formed against you shall prosper, And every tongue which rises against you in judgment you shall condemn. This is the heritage of the servants of the LORD, "And their righteousness is from Me," Says the LORD. Isaiah 54:17

MOUNT VEMA

17 YEARS OF ROYAL HISTORY

Home | Contact | News | Banking | Currency | Shopping | Freight | Travel | Jobs | Real Estate | Weather | Search | 912 Emergencies | LOG IN

The Legal Entities of Mount Vema

|

COUNTRY

|

COUNTRY CODE

COUNTRY CODES IN USE Mount Vema Country Code: OV / MOV Mount Vema Numeric Country Code: 507 Currency Code: VSG Top-Level Domain: .com, and .ov (proposed) Proposed Telephone Country Code: +294 |

|

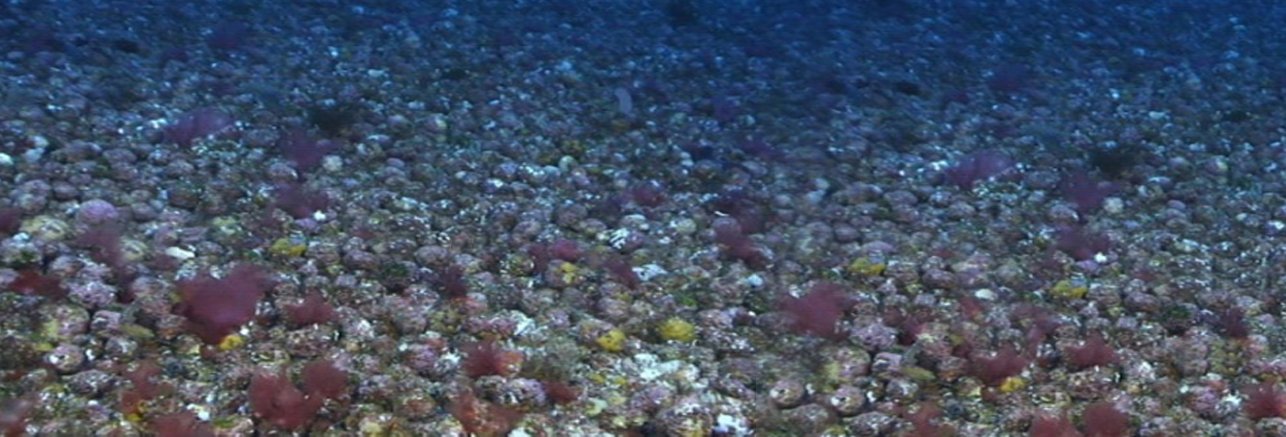

International Treaties – Ratified by the Kingdom of Mount Vema

Law of the Sea Treaty (United Nations Convention on the Law of the Sea) MARPOL 73/78 (Convention for the Prevention of Pollution from Ships) The Vienna Convention on Diplomatic Relations of 1961 The Vienna Convention on Consular Relations 1963 |

State Alert! – Security, Public Safety and Emergencies

YELLOW WARNING official advise to be aware. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>