Revenue Services

His Mount Vema Majesty’s Revenue Services

The HMVM Revenue Services - His Mount Vema Majesty's Revenue Services is a department responsible for the administration and collection of direct taxes including individual income tax, corporation tax, capital taxes such as capital gains tax and inheritance tax, payroll tax, indirect taxes (including value added tax), excise duties and stamp duty. Other aspects of the department's responsibilities include contributions to the treasury, the distribution of benefits and some other forms of state support including administering anti-money laundering registrations for Money Service Businesses and collection and publication of the trade-in-goods statistics.

All businesses and residents within the Jurisdiction of His Mount Vema Majesty's realm are charged corporate tax and individual income tax, including pension. This information is to clarify on any misconception, and to reassure government bond investors and partners that His Mount Vema Majesty's Government runs its territory in accordance with internationally recognized principles of good governance, and it is not and neither it intends to be an offshore tax haven. The Kingdom of Mount Vema may have much lower taxes in comparison to other countries, but it is not a tax-free jurisdiction, in addition to income, all residents are required to pay tax in the form of VAT on all goods and services plus ISN contributions. Furthermore, corporations are required to pay tax on profits – unless they can demonstrate that their turnover is generated outside of the confines of His Mount Vema Majesty’s realm. In this case they must pay the ‘AMVS Tax’ (Annual Mount Vema State Tax) which is only applicable to entities that can demonstrate that their turnover is generated outside of the confines of His Mount Vema Majesty’s realm. The amount payable for ‘AMVS Tax’ is a flat fee 500 golles. This tax obligation is payable annually before or no later than the 31st of August.

Personal Income Tax

Mount Vema citizens living overseas are required to contribute 10% of their global income to the revenue services, regardless of where in the world they live. This requirement does not apply to legal residents who will live and work in Mount Vema and who will be required to have a Mount Vema Social Security Number (ISN) to work.

This requirement does not affect Mount Vema citizens living in countries with taxation agreements or special arrangements with Mount Vema to eliminate dual Social Security taxation. Which can occur when a worker from one country works in another country and is required to pay Social Security taxes to both countries on the same earnings.

Legal residents will pay 32% income which covers the cost of free healthcare, education, social services, including contribution to the state pension, district tax, and other basic services provided by the state to residents.

However, Mount Vema citizens are required to pay 32% of their income if living and working in Mount Vema plus an additional 10% (32% + 10% = 42%), or to pay a basic 10% of their global income if living overseas either by reporting their income or by making voluntary contributions to His Mount Vema Majesty’s Treasury through a special arrangement.

Why are Mount Vema citizens required to pay 10%?

This policy cover for the cost of maintaining the security of the realm, global healthcare for all citizens of Mount Vema, international social housing, and the cost of providing basic income for all Mount Vema citizens worldwide who may be temporarily unemployed (seeking employment), or unemployed due to health reasons, and general services provided by the state to all citizens of the Kingdom of Mount Vema, including contribution to the state pension.

This requirement does not affect Mount Vema citizens living in countries with taxation agreements or special arrangements with Mount Vema to eliminate dual Social Security taxation. Which can occur when a worker from one country works in another country and is required to pay Social Security taxes to both countries on the same earnings.

Legal residents will pay 32% income which covers the cost of free healthcare, education, social services, including contribution to the state pension, district tax, and other basic services provided by the state to residents.

However, Mount Vema citizens are required to pay 32% of their income if living and working in Mount Vema plus an additional 10% (32% + 10% = 42%), or to pay a basic 10% of their global income if living overseas either by reporting their income or by making voluntary contributions to His Mount Vema Majesty’s Treasury through a special arrangement.

Why are Mount Vema citizens required to pay 10%?

This policy cover for the cost of maintaining the security of the realm, global healthcare for all citizens of Mount Vema, international social housing, and the cost of providing basic income for all Mount Vema citizens worldwide who may be temporarily unemployed (seeking employment), or unemployed due to health reasons, and general services provided by the state to all citizens of the Kingdom of Mount Vema, including contribution to the state pension.

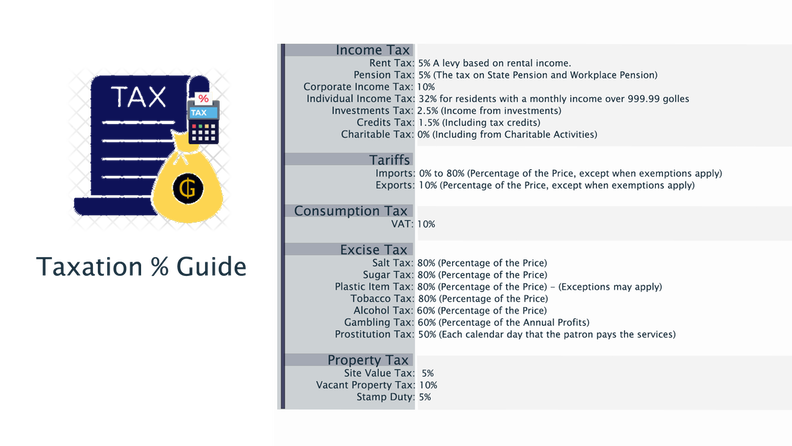

Income Tax

Rent Tax: 5%

A levy based on rental income. The property owner will be responsible for withholding and sending the Rent Tax on to The Revenue Services each month.

Pension Tax: 5% (The tax on State Pension and Workplace Pension)

Corporate Income Tax: 10%

Individual Income Tax: 32% for residents, plus an additional 10% for Mount Vema Citizens

Income from investments - Tax: 2.5%

Credits, including tax credits: 1.5%

Income from Charitable Activities - Tax: 0%

The taxable income of the taxpayer resident will be the total income less income producing expenses and other deductions. Only the net gain from sale of property, including goods held for sale, will be included in income.

Income of a corporation's shareholders will include distributions of profits from the corporation. Deductions will include all income producing or business expenses including an allowance for recovery of costs of business assets.

The Kingdom of Mount Vema will require self-assessment of the tax and will require payers of some types of income to withhold tax from those payments. Advance payments of tax by taxpayers may be required. Taxpayers not timely paying tax owed may be subject to significant penalties, which may include jail for individuals or revocation of an entity's legal existence.

Employers Reporting (Individual Income Tax)

Employers are responsible for Withholding and sending the Income Tax on to The Revenue Services each month, along with various other employment taxes. The amounts deducted from each payment to individual employees must be reported using an electronic submission on or before the day payment is made. When reporting employee income, it must include bonuses, overtime and non-cash payments such as "benefits in kind" (including the use of a company car, company property, etc). At the end of each tax year, the employer must give the employee the FormA121 as a certificate of Pay, and Tax deducted during the year.

A FormE121 must be given by an employer to an employee on cessation of employment to certify the employee's pay, and tax contributions from the start of the tax year to date of cessation and also certify that the deductions have been made in accordance with the instructions given by His Mount Vema Majesty's Revenue Services.

Legal Entities Reporting (Income Tax)

All legal entities must submit FormN1220 to the Revenue Services with their respective annual reports at the end of each tax year.

Rent Tax: 5%

A levy based on rental income. The property owner will be responsible for withholding and sending the Rent Tax on to The Revenue Services each month.

Pension Tax: 5% (The tax on State Pension and Workplace Pension)

Corporate Income Tax: 10%

Individual Income Tax: 32% for residents, plus an additional 10% for Mount Vema Citizens

Income from investments - Tax: 2.5%

Credits, including tax credits: 1.5%

Income from Charitable Activities - Tax: 0%

The taxable income of the taxpayer resident will be the total income less income producing expenses and other deductions. Only the net gain from sale of property, including goods held for sale, will be included in income.

Income of a corporation's shareholders will include distributions of profits from the corporation. Deductions will include all income producing or business expenses including an allowance for recovery of costs of business assets.

The Kingdom of Mount Vema will require self-assessment of the tax and will require payers of some types of income to withhold tax from those payments. Advance payments of tax by taxpayers may be required. Taxpayers not timely paying tax owed may be subject to significant penalties, which may include jail for individuals or revocation of an entity's legal existence.

Employers Reporting (Individual Income Tax)

Employers are responsible for Withholding and sending the Income Tax on to The Revenue Services each month, along with various other employment taxes. The amounts deducted from each payment to individual employees must be reported using an electronic submission on or before the day payment is made. When reporting employee income, it must include bonuses, overtime and non-cash payments such as "benefits in kind" (including the use of a company car, company property, etc). At the end of each tax year, the employer must give the employee the FormA121 as a certificate of Pay, and Tax deducted during the year.

A FormE121 must be given by an employer to an employee on cessation of employment to certify the employee's pay, and tax contributions from the start of the tax year to date of cessation and also certify that the deductions have been made in accordance with the instructions given by His Mount Vema Majesty's Revenue Services.

Legal Entities Reporting (Income Tax)

All legal entities must submit FormN1220 to the Revenue Services with their respective annual reports at the end of each tax year.

AMVS Tax

Annual Mount Vema State Tax

The AMVS Tax (Annual Mount Vema State Tax) is a government levy charged to certain business organizations such as corporations and partnerships registered with the Mount Vema Companies Agency but operating outside the jurisdiction of the Kingdom of Mount Vema. This is a tax not based on income, it is a charge to corporations for the privilege of being registered with Mount Vema. ‘AMVS Tax’ is only applicable to entities that can demonstrate that their turnover is generated outside of the confines of His Mount Vema Majesty’s realm. The amount payable for ‘AMVS Tax’ is a flat fee 500 golles. This tax obligation is payable annually before or no later than the 31st of August.

Annual Mount Vema State Tax

The AMVS Tax (Annual Mount Vema State Tax) is a government levy charged to certain business organizations such as corporations and partnerships registered with the Mount Vema Companies Agency but operating outside the jurisdiction of the Kingdom of Mount Vema. This is a tax not based on income, it is a charge to corporations for the privilege of being registered with Mount Vema. ‘AMVS Tax’ is only applicable to entities that can demonstrate that their turnover is generated outside of the confines of His Mount Vema Majesty’s realm. The amount payable for ‘AMVS Tax’ is a flat fee 500 golles. This tax obligation is payable annually before or no later than the 31st of August.

Customs Duty, Licensing and Business Registration Requirements

Customs Duty:

The Kingdom of Mount Vema imposes tariffs or "customs duties" on imports of goods. The duty is levied at the time of import paid by the importer of record. Individuals arriving in Mount Vema may be exempt from duty on a limited number of purchases, and on goods temporarily imported (such as laptop computers etc). The customs duties varies by country of origin and product, which may range from zero to 80% of the value of the goods. Failure to comply with customs rules can result in seizure of goods and civil and criminal penalties against involved parties. All goods entering the Kingdom of Mount Vema are subject to inspection prior to legal entry.

Duty-Free Goods

Travelers may bring goods into the Kingdom of Mount Vema duty-free. These goods may be bought at the port and airport without attracting the usual government taxes and then brought into another country duty-free. His Mount Vema Majesty’s Government may impose allowances to limit the number or value of duty-free items that one person can bring into the country. These restrictions may not apply only to tobacco, wine, spirits, cosmetics, gifts, and souvenirs. Foreign diplomats are entitled to duty-free goods. Duty-free goods may be imported and stocked in His Mount Vema Majesty’s Government bonded warehouse.

Tariffs (imports): 0% to 80% (Percentage of the Price, except when exemptions apply)

This is a tax imposed on imports of goods from jurisdictions outside Mount Vema. The rate may be adjusted from time to time per types of item, reduced or waved when reciprocal free trade arrangements apply, or reciprocal use of free ports.

Policy on economic barrier to entry applies to tariffs

Note: Mount Vema taxes all goods entering into its market, and especially those which can be produced domestically. There are some economic barriers to entry, which is a cost that must be incurred by a new entrant into the Mount Vema Market when incumbents do not have or have not had to incur.

Licensing and business registration requirements

All individuals and companies doing business in Mount Vema must obtain a Basic Business License and register their business. Some types of businesses require additional certification or permits beyond the Basic Business License and registration. The Office of Fair Trade ensures the health, safety, and economic welfare of District residents through licensing, inspection, compliance, and enforcement programs. In addition, the Office issues certain professional licenses, to regulate public space, and control land use through zoning.

Mount Vema requires a "Clearance Self-Certification" from most applicants, which is an affidavit stating that the applicant does not owe more than 500 golles to the District or to the State. Tour Guides must submit a Physician's Certificate. Fees for businesses licenses vary. For example the fee for a Special Event license such as a marathon is 1000.00 golles. The license for a movie theater costs 5000.00 golles per year, for a grocery store 2.000.00 golles per year, for a beauty shop 800.00 per year. Education, healthcare, physicians and other professionals also require occupational licenses, to meet quota limits on the number of people who can enter a certain profession.

Tariffs (exports): 10% fixed (Percentage of the Price, except when exemptions apply)

This is a tax imposed on exports of goods to from jurisdictions outside Mount Vema. The rate may be adjusted, reduced, or waved when reciprocal free trade arrangements apply.

Customs Duty:

The Kingdom of Mount Vema imposes tariffs or "customs duties" on imports of goods. The duty is levied at the time of import paid by the importer of record. Individuals arriving in Mount Vema may be exempt from duty on a limited number of purchases, and on goods temporarily imported (such as laptop computers etc). The customs duties varies by country of origin and product, which may range from zero to 80% of the value of the goods. Failure to comply with customs rules can result in seizure of goods and civil and criminal penalties against involved parties. All goods entering the Kingdom of Mount Vema are subject to inspection prior to legal entry.

Duty-Free Goods

Travelers may bring goods into the Kingdom of Mount Vema duty-free. These goods may be bought at the port and airport without attracting the usual government taxes and then brought into another country duty-free. His Mount Vema Majesty’s Government may impose allowances to limit the number or value of duty-free items that one person can bring into the country. These restrictions may not apply only to tobacco, wine, spirits, cosmetics, gifts, and souvenirs. Foreign diplomats are entitled to duty-free goods. Duty-free goods may be imported and stocked in His Mount Vema Majesty’s Government bonded warehouse.

Tariffs (imports): 0% to 80% (Percentage of the Price, except when exemptions apply)

This is a tax imposed on imports of goods from jurisdictions outside Mount Vema. The rate may be adjusted from time to time per types of item, reduced or waved when reciprocal free trade arrangements apply, or reciprocal use of free ports.

Policy on economic barrier to entry applies to tariffs

Note: Mount Vema taxes all goods entering into its market, and especially those which can be produced domestically. There are some economic barriers to entry, which is a cost that must be incurred by a new entrant into the Mount Vema Market when incumbents do not have or have not had to incur.

- Distributor agreements - Exclusive agreements must be made with licensed distributors or licensed retailers.

- Intellectual property - Potential entrant require access to equally efficient production technology as the one already in use in order to freely enter the market. Trademarks, Servicemarks and Patents owners have the legal right to stop other firms producing a product for a given period of time, and so restrict entry into the market.

- Restrictive practices - Agreements are required such as (landing slots) air transport agreements, etc.

- Supplier agreements - Exclusive agreements with key links in the supply chain are required.

Licensing and business registration requirements

All individuals and companies doing business in Mount Vema must obtain a Basic Business License and register their business. Some types of businesses require additional certification or permits beyond the Basic Business License and registration. The Office of Fair Trade ensures the health, safety, and economic welfare of District residents through licensing, inspection, compliance, and enforcement programs. In addition, the Office issues certain professional licenses, to regulate public space, and control land use through zoning.

Mount Vema requires a "Clearance Self-Certification" from most applicants, which is an affidavit stating that the applicant does not owe more than 500 golles to the District or to the State. Tour Guides must submit a Physician's Certificate. Fees for businesses licenses vary. For example the fee for a Special Event license such as a marathon is 1000.00 golles. The license for a movie theater costs 5000.00 golles per year, for a grocery store 2.000.00 golles per year, for a beauty shop 800.00 per year. Education, healthcare, physicians and other professionals also require occupational licenses, to meet quota limits on the number of people who can enter a certain profession.

Tariffs (exports): 10% fixed (Percentage of the Price, except when exemptions apply)

This is a tax imposed on exports of goods to from jurisdictions outside Mount Vema. The rate may be adjusted, reduced, or waved when reciprocal free trade arrangements apply.

Consumption Tax

Consumption Tax: 10%

VAT (Value-Added Tax), levy on consumption spending on goods and services. This tax may be adjusted from time to time per category.

Excise Tax:

This is a levy on certain types of goods that may come into existence in Mount Vema.

Salt Tax: 80% (Percentage of the Price)

Sugar Tax: 80% (Percentage of the Price)

Single Use Plastic Item Tax: 80% (Percentage of the Price) - (some exceptions may apply)

Tobacco Tax: 80% (Percentage of the Price)

Alcohol Tax: 60% (Percentage of the Price)

Gambling Tax: 60% (Percentage of the Annual Profits)

Prostitution Tax: 50% (Each calendar day that the patron pays the prostitution services)

Consumption Tax: 10%

VAT (Value-Added Tax), levy on consumption spending on goods and services. This tax may be adjusted from time to time per category.

Excise Tax:

This is a levy on certain types of goods that may come into existence in Mount Vema.

Salt Tax: 80% (Percentage of the Price)

Sugar Tax: 80% (Percentage of the Price)

Single Use Plastic Item Tax: 80% (Percentage of the Price) - (some exceptions may apply)

Tobacco Tax: 80% (Percentage of the Price)

Alcohol Tax: 60% (Percentage of the Price)

Gambling Tax: 60% (Percentage of the Annual Profits)

Prostitution Tax: 50% (Each calendar day that the patron pays the prostitution services)

Property Tax

Site Value Tax: 5%

A levy on the value of the unit (a site used to moor a floating property) or a reclaimed land, paid annually by the owner (the leaseholder) of the unit (land) excluding the value of buildings and other improvements when such assets are not yet part of the site.

The levy on the value of the unit must be paid annually by the property owner (not the site owner) when, the value of the site includes the value of buildings and other improvements already part of the unit.

Vacant Property Tax: 10%

A levy on vacant properties. This tax can be paid to the Revenue Services by the owner either annually, or as long as the property remains vacant.

Stamp Duty: 5%

This is a tax imposed at the time of a real estate or title plan transaction (real estate transfer tax). It must be paid within 14 days of completion of a transaction, to the Revenue Services. If you have a solicitor, agent or conveyancer, they’ll usually file your return and pay the tax on your behalf on the day of completion and add the amount to their fees.

District Tax:

District Tax is a levy based on a fixed amount for each band to fund district expenditure. The more valuable the property, the higher the tax. The district expenditure includes garbage collection, waste management, the sewer system, breakwaters management, district police, and the fire rescue services.

The occupiers of a property are liable, regardless of tenure, or the owners if the property is unoccupied, except if the property is a 'house in multiple occupation', in which case the landlord is liable for paying the District Tax. The property owner will be responsible for withholding the payment and sending the District Tax on to The Revenue Services each year.

Site Value Tax: 5%

A levy on the value of the unit (a site used to moor a floating property) or a reclaimed land, paid annually by the owner (the leaseholder) of the unit (land) excluding the value of buildings and other improvements when such assets are not yet part of the site.

The levy on the value of the unit must be paid annually by the property owner (not the site owner) when, the value of the site includes the value of buildings and other improvements already part of the unit.

Vacant Property Tax: 10%

A levy on vacant properties. This tax can be paid to the Revenue Services by the owner either annually, or as long as the property remains vacant.

Stamp Duty: 5%

This is a tax imposed at the time of a real estate or title plan transaction (real estate transfer tax). It must be paid within 14 days of completion of a transaction, to the Revenue Services. If you have a solicitor, agent or conveyancer, they’ll usually file your return and pay the tax on your behalf on the day of completion and add the amount to their fees.

District Tax:

District Tax is a levy based on a fixed amount for each band to fund district expenditure. The more valuable the property, the higher the tax. The district expenditure includes garbage collection, waste management, the sewer system, breakwaters management, district police, and the fire rescue services.

The occupiers of a property are liable, regardless of tenure, or the owners if the property is unoccupied, except if the property is a 'house in multiple occupation', in which case the landlord is liable for paying the District Tax. The property owner will be responsible for withholding the payment and sending the District Tax on to The Revenue Services each year.

No weapon formed against you shall prosper, And every tongue which rises against you in judgment you shall condemn. This is the heritage of the servants of the LORD, "And their righteousness is from Me," Says the LORD. Isaiah 54:17

MOUNT VEMA

17 YEARS OF ROYAL HISTORY

Home | Contact | News | Banking | Currency | Shopping | Freight | Travel | Jobs | Real Estate | Weather | Search | 912 Emergencies | LOG IN

The Legal Entities of Mount Vema

|

COUNTRY

|

COUNTRY CODE

COUNTRY CODES IN USE Mount Vema Country Code: OV / MOV Mount Vema Numeric Country Code: 507 Currency Code: VSG Top-Level Domain: .com, and .ov (proposed) Proposed Telephone Country Code: +294 |

|

International Treaties – Ratified by the Kingdom of Mount Vema

Law of the Sea Treaty (United Nations Convention on the Law of the Sea) MARPOL 73/78 (Convention for the Prevention of Pollution from Ships) The Vienna Convention on Diplomatic Relations of 1961 The Vienna Convention on Consular Relations 1963 |

State Alert! – Security, Public Safety and Emergencies

YELLOW WARNING official advise to be aware. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>