Economy of Mount Vema

|

The Economy of the Kingdom of Mount Vema

|

The Kingdom of Mount Vema has a prosperous economy, based on a comparison of GDP measured at purchasing power parity conversion rates. The Mount Vema real estate although off-plan, is already highly valuable. The 1.2 trillion golles total value of the Kingdom of Mount Vema entire projected property stock and the Vema Seamount territory itself is more than the combined gross domestic products (GDP) of some well-developed countries. The Mount Vema Territory with its marine life alone is an asset that represents the value of ownership of the Vema Seamount Authority that can be converted into cash as collateral at any time to enable His Mount Vema Majesty’s Government to raise finance to pay for the country’s obligations.

The economy of the Kingdom of Mount Vema is expected to continue to grow steadily for the next four to five decades.

Finances of the State

His Mount Vema Majesty’s Treasury is responsible for developing and executing the government's finance policy and economic strategy. The Bank of Mount Vema (an agency of the Royal Mount Vema Reserve Bank) is the central bank of the Kingdom of Mount Vema, and is responsible for issuing notes and coins in the nation's currency, the Mount Vema golle which is becoming an important global reserve currency.

Purchasing Power of the Currency of Mount Vema

The Mount Vema real estate although off-plan, is highly valuable. The 1.2 trillion golles total value of the Kingdom of Mount Vema entire projected property stock and the Vema Seamount territory itself is more than the combined gross domestic products (GDP) of some well-developed countries. The golle (the Mount Vema currency) can be exchanged to any leading currency through GolleCard and can also be used to pay for goods and services worldwide from this website, and especially on GolleMARKET from anywhere in the world, for worldwide delivery.

Investments and Growth

Mount Vema has a stable economy which attracts a large amount of direct foreign investments through the RBMV Bank, due to the territory's corruption free environment, and long-term growth strategy. This is an economy where the Government buys needed goods and services predominantly in the private marketplace, and private individuals and business firms make most of the decisions. Firms also enjoy great flexibility in decisions to expand, to develop new products, and lay off surplus workers.

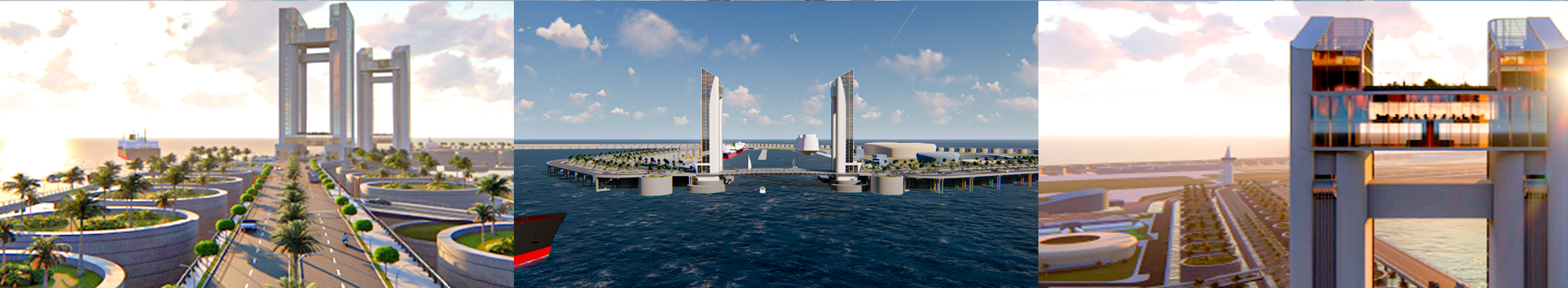

The economy of Mount Vema is starting with an initial concentration on the construction industry and logistics. It will later be followed by other heavy industries such as shipbuilding which will be needed to maintain the floating city structures that, will provide the platform for merchants, and shippers to expand. However, fisheries, banking, financial services, and tourism are likely to become the most important part of the economy in years to come.

Employment and Jobs Creation

The legal entities of Mount Vema already employ and recruit thousands of people worldwide through third parties and through W-Contractors. However, although the government plans to place limits on inflows of workers to Mount Vema, foreign workers will make up 99% of the construction industry and up to 90% of the service industry after the construction of the City of Mount Vema. So foreign workers will be crucial to the country's domestic and overseas economy as the legal entities of the Kingdom of Mount Vema aim to become among the largest creators of employment across the world.

Taxation

Mount Vema tax is progressive, and is currently levied by the state to Mount Vema citizens worldwide. Citizens are taxed 10% on their income irrespective of where they live or where their income is earned. However when the construction of the City of Mount Vema is completed, tax will also be levied to residents living and working in Mount Vema, and will be taxed on their income to cover the cost of basic services to be provided by the state.

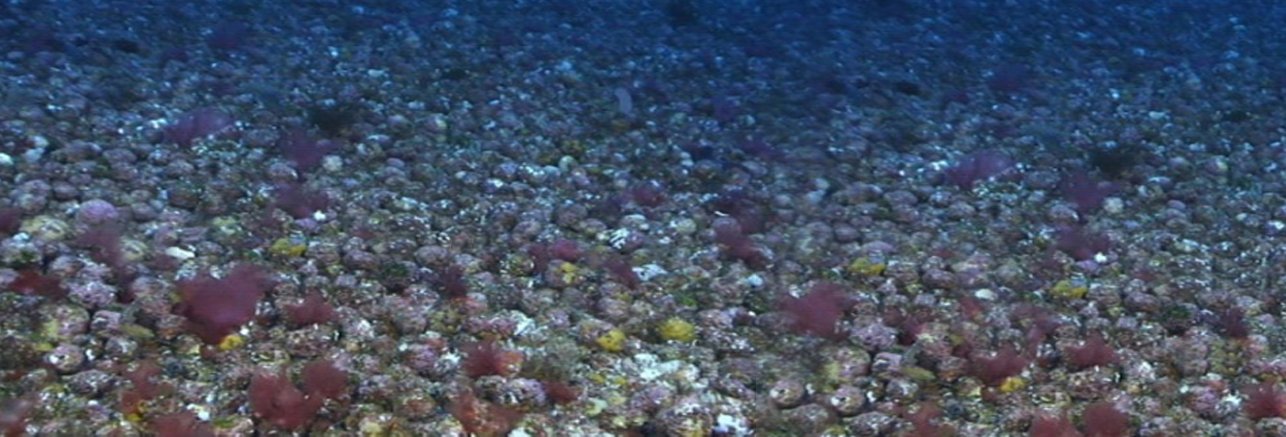

Fisheries

Fisheries is another source of government revenues. Although currently the government makes very little use of this option as it forms part of His Mount Vema Majesty’s Reserves and requires the approval of The Sovereign - The Vema Seamount territory. However with its marine life alone fisheries is an asset that represents the value of ownership of the Vema Seamount Authority that can be converted into cash as collateral at any time to enable His Mount Vema Majesty’s Government to raise finance to pay for the country’s obligations.

Expenditure

The annual spending budget is determined by the country’s debt ceiling, signed by the Sovereign every August and announced on the first week of September. Although the total estimated value of the City of Mount Vema entire projected real estate is more than 1.2 trillion golles, the estimated annual operational and development expenditure by 2030 is 16.4 billion golles from the projected income of 32 billion golles from fisheries, services, and returns from long term strategic investments.

Tourism

No other floating city or floating city-state in the world will be like Mount Vema, not at least for the next 100 years, everything Mount Vema does now is pioneering. So, tourism is expected to be a major industry and contributor to the Mount Vema economy, however projections in terms of total number of visitors per year are not yet available.

Finances of the State

His Mount Vema Majesty’s Treasury is responsible for developing and executing the government's finance policy and economic strategy. The Bank of Mount Vema (an agency of the Royal Mount Vema Reserve Bank) is the central bank of the Kingdom of Mount Vema, and is responsible for issuing notes and coins in the nation's currency, the Mount Vema golle which is becoming an important global reserve currency.

Purchasing Power of the Currency of Mount Vema

The Mount Vema real estate although off-plan, is highly valuable. The 1.2 trillion golles total value of the Kingdom of Mount Vema entire projected property stock and the Vema Seamount territory itself is more than the combined gross domestic products (GDP) of some well-developed countries. The golle (the Mount Vema currency) can be exchanged to any leading currency through GolleCard and can also be used to pay for goods and services worldwide from this website, and especially on GolleMARKET from anywhere in the world, for worldwide delivery.

Investments and Growth

Mount Vema has a stable economy which attracts a large amount of direct foreign investments through the RBMV Bank, due to the territory's corruption free environment, and long-term growth strategy. This is an economy where the Government buys needed goods and services predominantly in the private marketplace, and private individuals and business firms make most of the decisions. Firms also enjoy great flexibility in decisions to expand, to develop new products, and lay off surplus workers.

The economy of Mount Vema is starting with an initial concentration on the construction industry and logistics. It will later be followed by other heavy industries such as shipbuilding which will be needed to maintain the floating city structures that, will provide the platform for merchants, and shippers to expand. However, fisheries, banking, financial services, and tourism are likely to become the most important part of the economy in years to come.

Employment and Jobs Creation

The legal entities of Mount Vema already employ and recruit thousands of people worldwide through third parties and through W-Contractors. However, although the government plans to place limits on inflows of workers to Mount Vema, foreign workers will make up 99% of the construction industry and up to 90% of the service industry after the construction of the City of Mount Vema. So foreign workers will be crucial to the country's domestic and overseas economy as the legal entities of the Kingdom of Mount Vema aim to become among the largest creators of employment across the world.

Taxation

Mount Vema tax is progressive, and is currently levied by the state to Mount Vema citizens worldwide. Citizens are taxed 10% on their income irrespective of where they live or where their income is earned. However when the construction of the City of Mount Vema is completed, tax will also be levied to residents living and working in Mount Vema, and will be taxed on their income to cover the cost of basic services to be provided by the state.

Fisheries

Fisheries is another source of government revenues. Although currently the government makes very little use of this option as it forms part of His Mount Vema Majesty’s Reserves and requires the approval of The Sovereign - The Vema Seamount territory. However with its marine life alone fisheries is an asset that represents the value of ownership of the Vema Seamount Authority that can be converted into cash as collateral at any time to enable His Mount Vema Majesty’s Government to raise finance to pay for the country’s obligations.

Expenditure

The annual spending budget is determined by the country’s debt ceiling, signed by the Sovereign every August and announced on the first week of September. Although the total estimated value of the City of Mount Vema entire projected real estate is more than 1.2 trillion golles, the estimated annual operational and development expenditure by 2030 is 16.4 billion golles from the projected income of 32 billion golles from fisheries, services, and returns from long term strategic investments.

Tourism

No other floating city or floating city-state in the world will be like Mount Vema, not at least for the next 100 years, everything Mount Vema does now is pioneering. So, tourism is expected to be a major industry and contributor to the Mount Vema economy, however projections in terms of total number of visitors per year are not yet available.

Mount Vema Exports

No weapon formed against you shall prosper, And every tongue which rises against you in judgment you shall condemn. This is the heritage of the servants of the LORD, "And their righteousness is from Me," Says the LORD. Isaiah 54:17

MOUNT VEMA

17 YEARS OF ROYAL HISTORY

Home | Contact | News | Banking | Currency | Shopping | Freight | Travel | Jobs | Real Estate | Weather | Search | 912 Emergencies | LOG IN

The Legal Entities of Mount Vema

|

COUNTRY

|

COUNTRY CODE

COUNTRY CODES IN USE Mount Vema Country Code: OV / MOV Mount Vema Numeric Country Code: 507 Currency Code: VSG Top-Level Domain: .com, and .ov (proposed) Proposed Telephone Country Code: +294 |

|

International Treaties – Ratified by the Kingdom of Mount Vema

Law of the Sea Treaty (United Nations Convention on the Law of the Sea) MARPOL 73/78 (Convention for the Prevention of Pollution from Ships) The Vienna Convention on Diplomatic Relations of 1961 The Vienna Convention on Consular Relations 1963 |

State Alert! – Security, Public Safety and Emergencies

YELLOW WARNING official advise to be aware. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>