A Limited Liability Partnership (LLP)

A Limited Liability Partnership (LLP) combines the benefits of the traditional partnership in respect of legal affairs and tax treatment together with that of limited liability to protect partners’ personal assets. Incorporation is a simple process, which we have tailored to provide an easy route to completion of the necessary formalities. Once you are happy with your decision that an LLP is the correct vehicle for your business venture, simply follow the order process and order your LLP online.

LLP incorporations are available electronically as with any other company, and the whole process is completed within hours.

As with any business partnership it is vital that the partners draw up a suitable written agreement to determine issues such as control, division of revenue and exit strategies. You may wish to consult your legal advisers in this respect or use our standardized LLP Partnership Agreement as a governing document. You will be given the option to include this during the order process, or please contact us for further details.

Key Points

A GUIDE TO LIMITED LIABILITY PARTNERSHIPS

Generally speaking, an LLP is taxed in much the same way that existing non-limited trading partnerships are taxed and maintains a very similar structure as a partnership. Unlike a limited company, an LLP has no Articles of Association, but is usually governed by a partnership agreement which determines how the business structure works, sets out responsibilities of those involved and provides dispute resolution and exit strategies.

It has always been expected that LLPs will prove most attractive to professional firms such as accountants and solicitors but your professional advisers will be able to indicate whether this would be suitable for your business.

The LLP, as with a Limited Company, is a separate legal entity, and whilst the LLP itself is responsible for its assets and liabilities, the liability of its members is limited and the members’ assets are protected in the eventuality of winding up of the business. As with limited companies, however, actions may be taken against individual members who are found to be negligent or fraudulent in their dealings.

Choosing a Name

The choice of name for an LLP follows the same rules as with limited companies. The Registrar of Companies maintains the registry in conjunction with the present list of company names. An LLP cannot have the same name as an existing LLP or limited company and the “same as” and “sensitive names” rules apply equally.

Structure of an LLP

An LLP must have at least two "designated members" at all times, otherwise the members' limited liability may be at risk. There is no specific requirement to have any non-designated members and there is no maximum to the number of members allowed. An LLP may be established such that all members are considered to be designated members.

In general terms, an LLP can be governed by the Partnership Agreement that may already be in force within an existing partnership, in conjunction with the general law, but there is no requirement to file any governing document. It is highly recommended that a formal agreement is established to ensure the business has a proper framework for the resolution of disputes between members or for the provision of suitable exit strategies. The partnership agreement may also determine revenue split between members and varying responsibilities if appropriate.

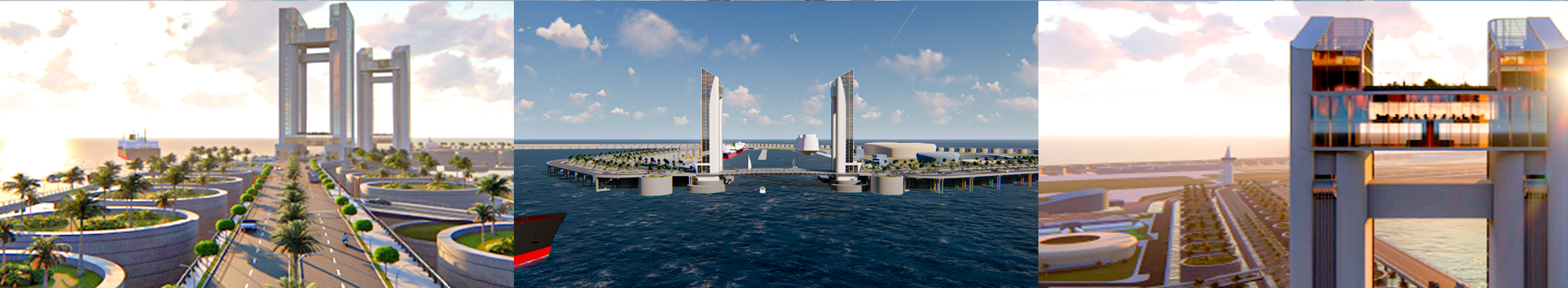

The LLP must also have an official registered office or must be listed on His Mount Vema Majesty's Government Official Website with its City of Mount Vema Project registered address off-plan, just as with a limited company, which is recorded by us. Unlike limited companies, there are no directors or company secretary, and of course, no shareholders.

Stationery

As with limited companies, there is certain information that must be displayed on an LLP's stationery. All e-mails, business letters, notices and publications, cheques, bills, invoices etc must bear the full name of the LLP including the words “Limited Liability Partnership” or the abbreviation “LLP”.

In addition, all business letters and order forms must show the following:

LLP incorporations are available electronically as with any other company, and the whole process is completed within hours.

As with any business partnership it is vital that the partners draw up a suitable written agreement to determine issues such as control, division of revenue and exit strategies. You may wish to consult your legal advisers in this respect or use our standardized LLP Partnership Agreement as a governing document. You will be given the option to include this during the order process, or please contact us for further details.

Key Points

- Suitable for new and existing partnerships wishing to obtain limited liability status, and aimed particularly at professional partnerships such as accountancy and solicitors firms

- Maintains tax status of a partnership

- Members have limited liability

- Incorporation within days

- Suitable for many commercial business activities where the owners wish to maintain elements of trading as a traditional partnership

- Must file Annual Returns and Annual Accounts

- Always seek professional advice on tax matters before deciding

A GUIDE TO LIMITED LIABILITY PARTNERSHIPS

Generally speaking, an LLP is taxed in much the same way that existing non-limited trading partnerships are taxed and maintains a very similar structure as a partnership. Unlike a limited company, an LLP has no Articles of Association, but is usually governed by a partnership agreement which determines how the business structure works, sets out responsibilities of those involved and provides dispute resolution and exit strategies.

It has always been expected that LLPs will prove most attractive to professional firms such as accountants and solicitors but your professional advisers will be able to indicate whether this would be suitable for your business.

The LLP, as with a Limited Company, is a separate legal entity, and whilst the LLP itself is responsible for its assets and liabilities, the liability of its members is limited and the members’ assets are protected in the eventuality of winding up of the business. As with limited companies, however, actions may be taken against individual members who are found to be negligent or fraudulent in their dealings.

Choosing a Name

The choice of name for an LLP follows the same rules as with limited companies. The Registrar of Companies maintains the registry in conjunction with the present list of company names. An LLP cannot have the same name as an existing LLP or limited company and the “same as” and “sensitive names” rules apply equally.

Structure of an LLP

An LLP must have at least two "designated members" at all times, otherwise the members' limited liability may be at risk. There is no specific requirement to have any non-designated members and there is no maximum to the number of members allowed. An LLP may be established such that all members are considered to be designated members.

In general terms, an LLP can be governed by the Partnership Agreement that may already be in force within an existing partnership, in conjunction with the general law, but there is no requirement to file any governing document. It is highly recommended that a formal agreement is established to ensure the business has a proper framework for the resolution of disputes between members or for the provision of suitable exit strategies. The partnership agreement may also determine revenue split between members and varying responsibilities if appropriate.

The LLP must also have an official registered office or must be listed on His Mount Vema Majesty's Government Official Website with its City of Mount Vema Project registered address off-plan, just as with a limited company, which is recorded by us. Unlike limited companies, there are no directors or company secretary, and of course, no shareholders.

Stationery

As with limited companies, there is certain information that must be displayed on an LLP's stationery. All e-mails, business letters, notices and publications, cheques, bills, invoices etc must bear the full name of the LLP including the words “Limited Liability Partnership” or the abbreviation “LLP”.

In addition, all business letters and order forms must show the following:

- The place of registration - eg; "Registered in Mount Vema"

- The registered number

- The fact that it is a Limited Liability Partnership

- The address of its registered office (The City of Mount Vema Project registered address off-plan)

- NOTE: This information must also be displayed on any web site owned or operated by the LLP.

No weapon formed against you shall prosper, And every tongue which rises against you in judgment you shall condemn. This is the heritage of the servants of the LORD, "And their righteousness is from Me," Says the LORD. Isaiah 54:17

MOUNT VEMA

17 YEARS OF ROYAL HISTORY

Home | Contact | News | Banking | Currency | Shopping | Freight | Travel | Jobs | Real Estate | Weather | Search | 912 Emergencies | LOG IN

The Legal Entities of Mount Vema

|

COUNTRY

|

COUNTRY CODE

COUNTRY CODES IN USE Mount Vema Country Code: OV / MOV Mount Vema Numeric Country Code: 507 Currency Code: VSG Top-Level Domain: .com, and .ov (proposed) Proposed Telephone Country Code: +294 |

|

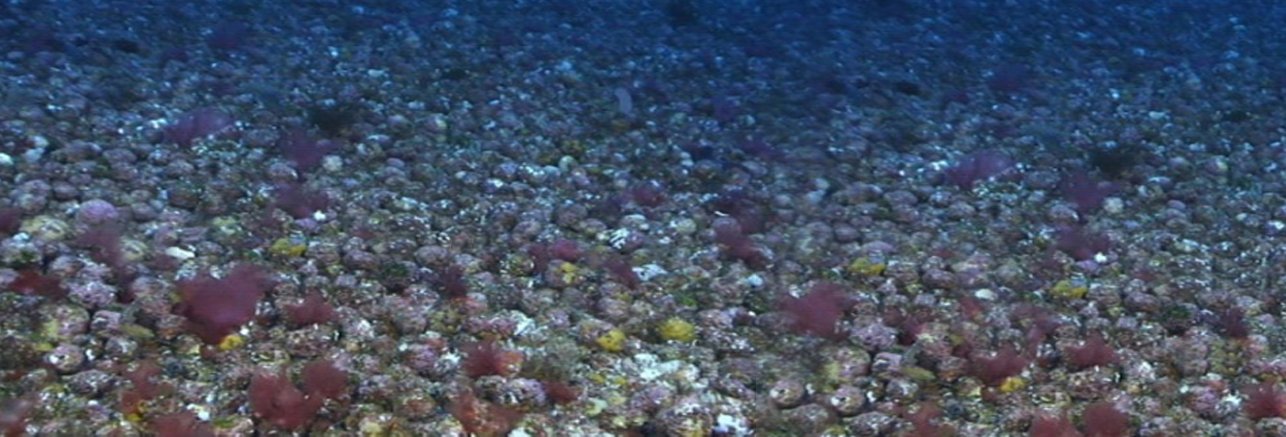

International Treaties – Ratified by the Kingdom of Mount Vema

Law of the Sea Treaty (United Nations Convention on the Law of the Sea) MARPOL 73/78 (Convention for the Prevention of Pollution from Ships) The Vienna Convention on Diplomatic Relations of 1961 The Vienna Convention on Consular Relations 1963 |

State Alert! – Security, Public Safety and Emergencies

YELLOW WARNING official advise to be aware. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>