Banking Licenses: Global actions worth trillions in foreign exchange triggers appetite for licenses12/29/2021

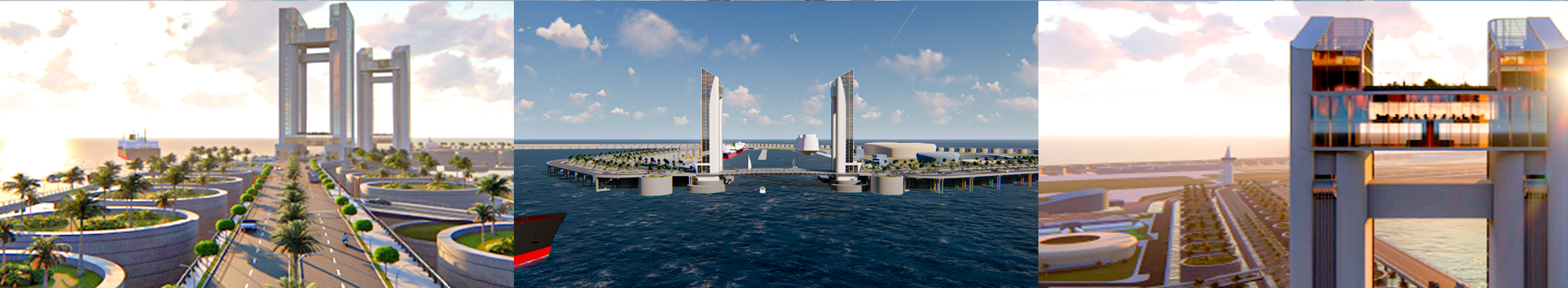

December 29, 2021 – Reserve Bank is inviting foreign banks and corporations to apply for a Mount Vema banking license after it authorized the Bank of Mount Vema to issue new banking licenses from January 2022, according to a press release issued by the Royal Mount Vema Reserve Bank.

The Reserve Bank said that Mount Vema is growing to become an economy with global activities worth trillions in foreign exchange, so its integration with other global financial institution is of great importance to the projected growth of His Mount Vema Majesty’s realm. Applicants who meet banking requirements are invited to submit letters of expression of interest through the official contact page of Mount Vema to the attention of the Banking License Officer at the Bank of Mount Vema. The types of banking licenses to be issued includes: Commercial banks: to deal with deposits and loans from corporations or large businesses with investments in Mount Vema projects worldwide. Private banks: to manage the assets of high-net-worth individuals with investments in Mount Vema projects worldwide. Direct and internet-only banks: to provide to City of Mount Vema project participants global banking operation services without the need for any physical bank branches. Transactions may be accomplished using agents, ATMs, electronic transfers, and direct deposits through an online interface. Acquiring banks: to processes credit or debit card payments in golles as well as foreign currency on behalf of Mount Vema registered merchants or City of Mount Vema project participants, and to allow merchants to accept credit card payments from Mount Vema card-issuing banks. Investment banks: to "underwrite" (guarantee the sale of) stock and bond issues, trade for their own accounts, make markets, provide investment management, and advise corporations on capital market activities such as mergers and acquisitions. Requirements for the issue of a Bank License The requirements for a Mount Vema bank license vary but include: Minimum capital: · Commercial banks: 5 million in golles or in foreign exchange · Private banks: 2.5 million in golles or in foreign exchange · Direct and internet-only banks: 1 million in golles or in foreign exchange · Acquiring banks: 1 million in golles or in foreign exchange · Investment banks: 10 million in golles or in foreign exchange Minimum capital ratio (CAR): CAR (Capital Adequacy Ratio) is currently 50% of risk-weighted credit exposures for Mount Vema licensed banks operating outside the Kingdom of Mount Vema. The ratio enables the regulator (Bank of Mount Vema) to track a bank's CAR to ensure that it can absorb a reasonable amount of loss and complies with Capital requirements to protect depositors and can absorb losses in the event of a winding-up, to promote stability and efficiency of the Mount Vema financial system. Bank Ownership: The bank's controllers, owners, directors, or senior officers must prove to be 'Fit and Proper' as matter of requirement. They will be vetted carefully. They must have no criminal record, no previous bankruptcy, have good business ethics, and previous experience in banking business. Business Plan: The bank's business plan must be sufficiently prudent and plausible and, must demonstrate how data will be protected and system safety. What happens after you obtain a Mount Vema banking license? · You must act in according with your approved business plan. · Your accounts will be reviewed quarterly. · Your audited accounts will be reviewed, and you will receive site visits for inspections. · You will have to obtain your swift number. · You will have to make arrangements to find a correspondent bank, when or if required to meet your operational needs. · You must have a City of Mount Vema off-plan address for filling purposes, and when the City of Mount Vema is built, a physical presence (an office in Mount Vema) will be required. The Mount Vema banking license is to operate outside Mount Vema only and, can be revoked. Owners of Mount Vema licensed banks will be able to transfer or sale their banking businesses, however new directors will need to be vetted to meet license requirements or apply for a new license. Applicants can be based anywhere in the world including countries with no tax information exchange agreement with the Kingdom of Mount Vema. The Reserve Bank will maintain a strong regulatory standard, and especially on money laundry, therefore you should only consider applying if your business can meet these requirements. So, with 500,000 golles or the equivalent in foreign exchange, plus the rate of capital, government fees, legal fees, and other expenses, you could get started with a Mount Vema banking license, that will enable you to raise capital, issue your own banking instruments such as bonds, letters of credit, grant loans, grant mortgages, make a profit, and more. Comments are closed.

|

|

No weapon formed against you shall prosper, And every tongue which rises against you in judgment you shall condemn. This is the heritage of the servants of the LORD, "And their righteousness is from Me," Says the LORD. Isaiah 54:17

MOUNT VEMA

17 YEARS OF ROYAL HISTORY

Home | Contact | News | Banking | Currency | Shopping | Freight | Travel | Jobs | Real Estate | Weather | Search | 912 Emergencies | LOG IN

The Legal Entities of Mount Vema

|

COUNTRY

|

COUNTRY CODE

COUNTRY CODES IN USE Mount Vema Country Code: OV / MOV Mount Vema Numeric Country Code: 507 Currency Code: VSG Top-Level Domain: .com, and .ov (proposed) Proposed Telephone Country Code: +294 |

|

International Treaties – Ratified by the Kingdom of Mount Vema

Law of the Sea Treaty (United Nations Convention on the Law of the Sea) MARPOL 73/78 (Convention for the Prevention of Pollution from Ships) The Vienna Convention on Diplomatic Relations of 1961 The Vienna Convention on Consular Relations 1963 |

State Alert! – Security, Public Safety and Emergencies

YELLOW WARNING official advise to be aware. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>