VemaGrowth is a Mount Vema regulated hedge fund and investment advisor established in 2007

Self-Service Investments for Portfolio Managers

Open an account and manage your own portfolios.

Open an account and manage your own portfolios.

The rules are simple. Your client management fees cannot exceed 4% per year. You may not charge your clients a fund performance fee which exceeds 30% of the increase in the fund's net asset value during a year.

What we do

At VemaGrowth, we use macro investing strategy. Taking large positions in share, bond, or currency markets in anticipation of global macroeconomic events in order to generate a risk-adjusted return.

We are committed to excellence in all aspects of our business.

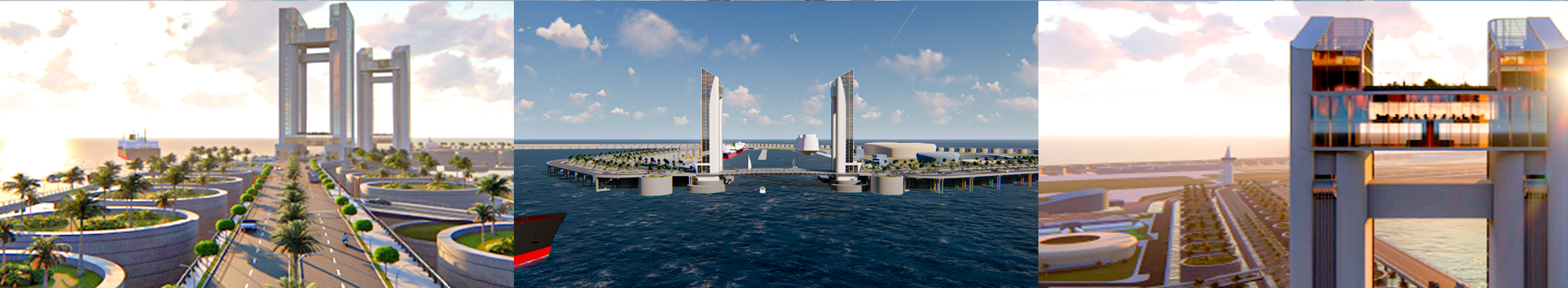

We serve institutional clients including pension funds, endowments, foundations, foreign governments, and central banks. Aiming to utilize a macro investing style based on economic trends such as inflation, currency exchange rates, and Mount Vema projects related to gross domestic product in-line with the evolution of the Kingdom of Mount Vema.

At VemaGrowth, we use macro investing strategy. Taking large positions in share, bond, or currency markets in anticipation of global macroeconomic events in order to generate a risk-adjusted return.

We are committed to excellence in all aspects of our business.

We serve institutional clients including pension funds, endowments, foundations, foreign governments, and central banks. Aiming to utilize a macro investing style based on economic trends such as inflation, currency exchange rates, and Mount Vema projects related to gross domestic product in-line with the evolution of the Kingdom of Mount Vema.

Investor, Transparency and Fees

Our clients may invest and withdraw capital periodically based on the fund's net asset value. Our aim is absolute return, to achieve a positive return on investment regardless of whether markets are rising or falling.

At VemaGrowth, we charge a management fee of 2% per year of the net asset value of the fund (paid monthly) and a performance fee of 20% of the increase in the fund's net asset value during a year. The management fees are designed to cover our operating costs, whereas the performance fee provides our profits.

From time to time, we may charge a redemption fee (or withdrawal fee) for early withdrawals during a specified period of time (typically a year), or when withdrawals exceed a predetermined percentage of the original investment.

NOTE: The information on this webpage does not constitute an offer to, or solicitation of, any potential clients or investors for the provision by VemaGrowth of investment management, advisory or any other related services. No material listed on this webpage is or should be construed as investment advice.

Our clients may invest and withdraw capital periodically based on the fund's net asset value. Our aim is absolute return, to achieve a positive return on investment regardless of whether markets are rising or falling.

At VemaGrowth, we charge a management fee of 2% per year of the net asset value of the fund (paid monthly) and a performance fee of 20% of the increase in the fund's net asset value during a year. The management fees are designed to cover our operating costs, whereas the performance fee provides our profits.

From time to time, we may charge a redemption fee (or withdrawal fee) for early withdrawals during a specified period of time (typically a year), or when withdrawals exceed a predetermined percentage of the original investment.

NOTE: The information on this webpage does not constitute an offer to, or solicitation of, any potential clients or investors for the provision by VemaGrowth of investment management, advisory or any other related services. No material listed on this webpage is or should be construed as investment advice.

Career

We are always looking for self-starters who are entrepreneurial, pioneers in the use of technology, performance-driven, and prudent in the face of risk. If you are interested in engaging with us, we'd welcome the opportunity to speak with you about career opportunities. Use the following link to send us your CV.

We are always looking for self-starters who are entrepreneurial, pioneers in the use of technology, performance-driven, and prudent in the face of risk. If you are interested in engaging with us, we'd welcome the opportunity to speak with you about career opportunities. Use the following link to send us your CV.

No weapon formed against you shall prosper, And every tongue which rises against you in judgment you shall condemn. This is the heritage of the servants of the LORD, "And their righteousness is from Me," Says the LORD. Isaiah 54:17

MOUNT VEMA

17 YEARS OF ROYAL HISTORY

Home | Contact | News | Banking | Currency | Shopping | Freight | Travel | Jobs | Real Estate | Weather | Search | 912 Emergencies | LOG IN

The Legal Entities of Mount Vema

|

COUNTRY

|

COUNTRY CODE

COUNTRY CODES IN USE Mount Vema Country Code: OV / MOV Mount Vema Numeric Country Code: 507 Currency Code: VSG Top-Level Domain: .com, and .ov (proposed) Proposed Telephone Country Code: +294 |

|

International Treaties – Ratified by the Kingdom of Mount Vema

Law of the Sea Treaty (United Nations Convention on the Law of the Sea) MARPOL 73/78 (Convention for the Prevention of Pollution from Ships) The Vienna Convention on Diplomatic Relations of 1961 The Vienna Convention on Consular Relations 1963 |

State Alert! – Security, Public Safety and Emergencies

YELLOW WARNING official advise to be aware. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>