GOLLECARD

|

Secure Payments

GolleCard is the leading processor of golle payments between the banks of merchants and card issuers worldwide.

Fees and charges per Gollecard transactions

- Charges per transaction in golles: 0.00 - Fees per transaction in golles: 1% - Fees per transaction in foreign currency: 1% - Annual fee: 0.00 golles |

The Most Reliable and Secure Form of Global Payments

Anytime / Anywhere / Any Currency

Work with us

Work with us

Gift Cards

Thinking about the ideal gift? At GolleCard, we know that not everyone has access to a debit or credit card. If this is your case, why not try a GolleCard Gift Card which is and can be made available to anyone anywhere in the world.

|

|

Prepaid Cards

GolleCard clears payments in Mount Vema golles anywhere, and brings unique digital payment systems to the unbanked around the world.

|

|

Card Issuing

Start issuing GolleCard credit cards to your customers and employees anywhere in any currency, free of charge

|

Merchant Services

Accept GolleCard Payments worldwide

GolleCard is the leading processor of golle payments, as well as foreign currency payments, between the banks of merchants and GolleCard issuers worldwide. We also provide GolleCard payment services free of charge to non-Mount Vema companies and entities, including foreign governments.

|

GolleCard Agents

|

Become an Agent

|

Agency Service Fees

We charge 0.75% per transaction in golles, and 2.50% per transaction in foreign currency. As the agent, you may charge up to 1.45% per transaction made in golles, and up to 2.50% per transaction made in other currencies.

What do I need to become an agent of GolleCard?

Depending on your country of residence and your retail location, but you'll generally need a smart phone, a computer, and internet connection. Once we've set up an account for you, you'll be able to provide GolleCard services and earn a commission on every GolleCard transaction from your retail locations(s).

Depending on your country of residence and your retail location, but you'll generally need a smart phone, a computer, and internet connection. Once we've set up an account for you, you'll be able to provide GolleCard services and earn a commission on every GolleCard transaction from your retail locations(s).

|

How will I earn money with GolleCard?

Each time a consumer tops up their GolleCard account, buy or sell Golles, or receives or makes any payment via GolleCard with Card, Cash or Cheque, they pay a transaction fee for the service. As a GolleCard agent, you'll earn a commission on the transaction fee for every transaction you process. The more transactions you process, the more you earn. What about Anti Money Laundering (AML) compliance? GolleCard has a leading AML program and provides first-class training and support to help you succeed as an agent and protect your business. What type of business do I need to have to be eligible? Many retail businesses make great GolleCard agents. Agents in our network own businesses as diverse as convenience stores, financial services providers, newsagents, pawnbrokers and travel agencies. Do I need to have a specific licence and will I be regulated? Yes, you will be regulated by the Bank of Mount Vema, through the Mount Vema Financial Services Authority but GolleCard will handle this for you. |

No weapon formed against you shall prosper, And every tongue which rises against you in judgment you shall condemn. This is the heritage of the servants of the LORD, "And their righteousness is from Me," Says the LORD. Isaiah 54:17

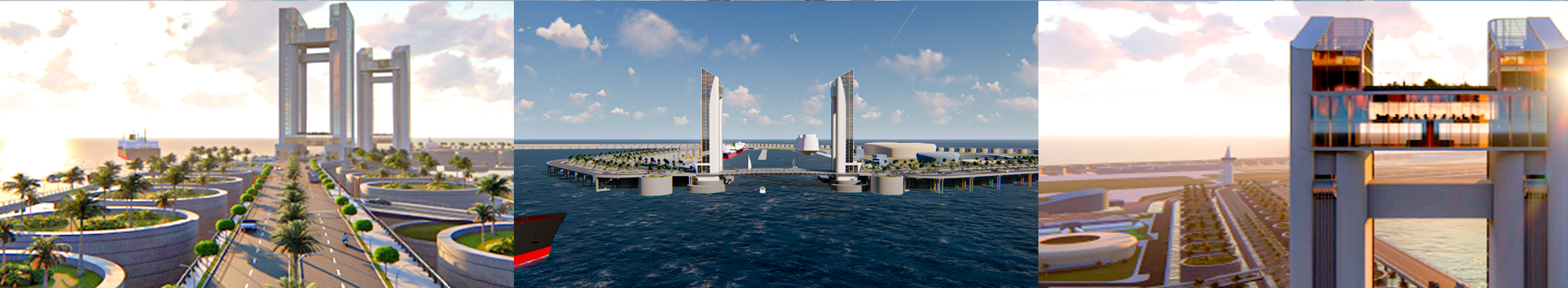

MOUNT VEMA

17 YEARS OF ROYAL HISTORY

Home | Contact | News | Banking | Currency | Shopping | Freight | Travel | Jobs | Real Estate | Weather | Search | 912 Emergencies | LOG IN

The Legal Entities of Mount Vema

|

COUNTRY

|

COUNTRY CODE

COUNTRY CODES IN USE Mount Vema Country Code: OV / MOV Mount Vema Numeric Country Code: 507 Currency Code: VSG Top-Level Domain: .com, and .ov (proposed) Proposed Telephone Country Code: +294 |

|

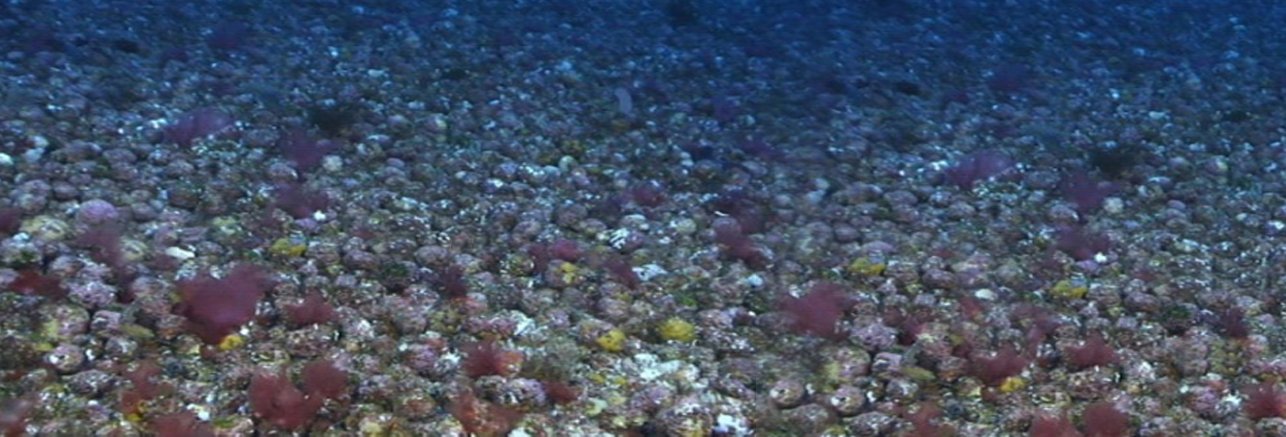

International Treaties – Ratified by the Kingdom of Mount Vema

Law of the Sea Treaty (United Nations Convention on the Law of the Sea) MARPOL 73/78 (Convention for the Prevention of Pollution from Ships) The Vienna Convention on Diplomatic Relations of 1961 The Vienna Convention on Consular Relations 1963 |

State Alert! – Security, Public Safety and Emergencies

YELLOW WARNING official advise to be aware. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>