MVG-BOND

A Mount Vema Government Bond (MVG-Bond) is a marketable security with fixed-interest debt issued by His Mount Vema Majesty’s Government with a 10 years maturity. Mount Vema Government bonds make interest payments semi-annually, and the income received is tax free.

This type of bond has the longest maturity and is issued quarterly. The first ten year bond was first issued back in 2007. It has a coupon payment every six months like MVG-Notes, and were commonly issued with maturity of ten years only, to meet demand mainly from pension funds and large, long-term institutional investors, although nowadays private investors have become the biggest holders of MVG-Bonds. |

Methods of Purchase

MVG-Bonds are available from the government with either a competitive or noncompetitive bid, and can be purchased by various types of entities, such as trusts, estates, partnerships, including individuals, organizations, foreign governments, and corporate investors through a broker or financial institution. Institutions and private investors may buy at the Primary Market. Or buy privately, directly from the Treasury of His Mount Vema Majesty's Government.

MVG-Bonds are available from the government with either a competitive or noncompetitive bid, and can be purchased by various types of entities, such as trusts, estates, partnerships, including individuals, organizations, foreign governments, and corporate investors through a broker or financial institution. Institutions and private investors may buy at the Primary Market. Or buy privately, directly from the Treasury of His Mount Vema Majesty's Government.

Trading MVG-Bonds – Secondary Market

MVG-Bonds are quoted for purchase and sale in the Secondary Market of the Mount Vema Stock Exchange, at a discount from the par value. When investors redeem their MVG-Bonds at maturity, they are paid the par value. The difference between the purchase price and par value is interest. For example, an investor purchases a par value 1,000 golles MVG-Bond for 800 golles. When this MVG-Bond matures, the investor is paid 1,000 golles, thereby making 200 golles on the investment. Plus a 5% annual income.

Benefits to Investors

There are a number of advantages that MVG-Bonds offer to investors. They are considered low-risk investments and the income received is tax free. With a minimum investment requirement of just 1000 golles, they are accessible by a wide range of investors. The main downfall of MVG-Bonds is that they offer lower returns than many other investments, but these lower returns are due to their low risk. Investments that offer higher returns generally come with more risk.

MVG-Bonds are quoted for purchase and sale in the Secondary Market of the Mount Vema Stock Exchange, at a discount from the par value. When investors redeem their MVG-Bonds at maturity, they are paid the par value. The difference between the purchase price and par value is interest. For example, an investor purchases a par value 1,000 golles MVG-Bond for 800 golles. When this MVG-Bond matures, the investor is paid 1,000 golles, thereby making 200 golles on the investment. Plus a 5% annual income.

Benefits to Investors

There are a number of advantages that MVG-Bonds offer to investors. They are considered low-risk investments and the income received is tax free. With a minimum investment requirement of just 1000 golles, they are accessible by a wide range of investors. The main downfall of MVG-Bonds is that they offer lower returns than many other investments, but these lower returns are due to their low risk. Investments that offer higher returns generally come with more risk.

Regulatory Body

The Mount Vema Securities and Exchange Council (MVSEC) is the regulatory body charged with overseeing the activities of the Gollexi. An agency with the mission to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.

The Mount Vema Securities and Exchange Council (MVSEC) is the regulatory body charged with overseeing the activities of the Gollexi. An agency with the mission to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.

Remember that trading in the stock market can result in the loss of your entire capital. Please ensure you fully understand the risks involved.

No weapon formed against you shall prosper, And every tongue which rises against you in judgment you shall condemn. This is the heritage of the servants of the LORD, "And their righteousness is from Me," Says the LORD. Isaiah 54:17

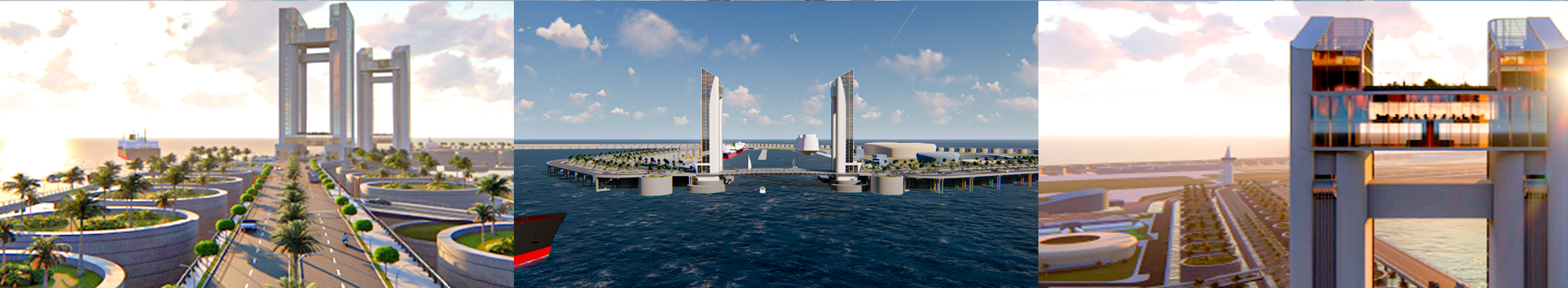

MOUNT VEMA

17 YEARS OF ROYAL HISTORY

Home | Contact | News | Banking | Currency | Shopping | Freight | Travel | Jobs | Real Estate | Weather | Search | 912 Emergencies | LOG IN

The Legal Entities of Mount Vema

|

COUNTRY

|

COUNTRY CODE

COUNTRY CODES IN USE Mount Vema Country Code: OV / MOV Mount Vema Numeric Country Code: 507 Currency Code: VSG Top-Level Domain: .com, and .ov (proposed) Proposed Telephone Country Code: +294 |

|

International Treaties – Ratified by the Kingdom of Mount Vema

Law of the Sea Treaty (United Nations Convention on the Law of the Sea) MARPOL 73/78 (Convention for the Prevention of Pollution from Ships) The Vienna Convention on Diplomatic Relations of 1961 The Vienna Convention on Consular Relations 1963 |

State Alert! – Security, Public Safety and Emergencies

YELLOW WARNING official advise to be aware. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>