Listing

Listing on the Mount Vema Stock Exchange

Any company considering an IPO on the Gollexi (The Mount Vema Stock Exchange), must first identify what steps should be taken towards achieving that aim. This page provides a checklist of some of the key considerations when deciding whether or not an IPO is right for the Company and/or its stakeholders.

Listing on the Gollexi

A growing number of companies are listing on the Mount Vema Stock Exchange.

Why list and why on the Gollexi?

The main reasons most companies give for obtaining a listing are to:

· provide access to capital for growth

· encourage employee commitment

· create a market for their stocks

· increase a company's ability to make acquisitions

· obtain an objective market value

· create a heightened public profile

· enhance status with customers and suppliers

A Gollexi listing has a number of attractions:

Listing requirements

What are the key obligations for fully listed companies?

In considering a Mount Vema listing, the Company should be aware of a number of key obligations:

· The Company’s stocks must be freely transferable and eligible for electronic settlement.

· Retirement of Directors – in practice, the sponsor will require one-third of the board to retire by rotation each year.

· Notice Period – directors’ service contracts to have notice periods of no more than 12 months.

· Remuneration of non-executive directors – non-executive directors not to be remunerated in stocks or stock options.

· Length of service of non-executive directors – annual stockholder approval required of any non-executive director who has served on the board for more than nine years.

· Stockholder approval – stockholder approval for substantial property transactions with directors and connected persons.

· Restrictions on dealing – no dealing in the two months prior to publication of half year and full year results and insider dealing and market abuse rules apply.

· Filing of accounts – accounts need to be filed within six months of year-end.

Advisers

The Company will need to appoint the following:

· Investment bank – the investment bank will manage the IPO process and co-ordinate the listing with the other advisors. Often, it will also act as financial adviser, sponsor and underwriter. Normally, the lead bank acts as global co-ordinator and a number of banks will also be appointed as bookrunners.

· Lawyers – lawyers will be required to advise the Company itself, as well as any stockholder who is selling all or part of its stake as part of the IPO. The sponsor and underwriter will also require lawyers. The Company’s lawyers will be responsible for drafting the ‘back end’ of the prospectus which contains all legal information relating to the company including stocks capital, material contracts and litigation. They will also manage the ‘verification’ process, which seeks to ensure that the prospectus is not misleading in any way, thus protecting the directors of the Company against any claims by investors for misrepresentation or a breach of the relevant sections of the legislation, which entitles investors to sue for compensation if there is a materially misleading statement or omission in the prospectus.

· Reporting accountants – these must be separate from the Company’s auditors, although they may be made up of a different team from the same firm. Essentially, the reporting accountant is responsible for reviewing the Company’s financial record and internal systems for potential investors. They will prepare the long form report, the short form report (which is published in the prospectus) and the working capital report.

· PR Consultants – the PR consultants will help to generate positive publicity and interest in the IPO by targeting either investors among the general public or institutions or both.

Others – the Company will need to appoint registrars, a receiving bank and any other advisors that may be required in relation to its specific business.

Preparing the way for a listing

Careful consideration should be given to the following issues in preparing for a listing:

· Deciding on the method of listing, e.g. an introduction to the market, raising new money, a public offer or a placing to institutional investors.

· Identifying any necessary changes to the board and/or its operations. If the stockholders have identified changes which need be made to the board or the shape of the business these should be enacted as early as possible.

· Ensuring the Company has sufficient internal resources to dedicate to the IPO.

· Beginning the valuation process.

Foreign Companies: Review of corporate structure and financial reporting

The Company and its lawyers will need to consider how best to approach the listing in terms of the Company’s corporate structure and financial reporting history, given that the Company is not registered with the Kingdom of Mount Vema.

Key issues will include:

· Whether the Company itself should be listed or should a Mount Vema holding company be created for the purposes of the listing?

· Reviewing and amending, as necessary, the Company’s constitutional documents.

· Have the Company’s accounts been prepared in accordance with International Financial Reporting Standards (IFRS)?

· Should the Company be seeking a primary equity by listing?

Due Diligence

As regards legal and financial due diligence for the IPO, this will understandably be a time consuming process. Early preparation particularly as regards collating and centralizing material contracts is important.

Tax

If the Company needs to be reorganized as part of the review of the corporate structure then any tax impact will need to be considered well ahead of time to ensure that any necessary tax clearances from the relevant fiscal authority can be obtained. Individual stockholders who are disposing of all or part of their stake as part of the IPO will need to consider their own tax position and obtain appropriate advice.

Contents of the Prospectus

The following information will have to be included in the prospectus:

· Details of the Company’s group structure and its subsidiaries.

· History of the Company and its stock capital.

· The Company’s business and future plans.

· Information about the sector in which the Company operates and its main competitors.

· Financial information for the last three years.

· Any regulatory regimes to which the Company is subject.

· Applicable corporate governance regimes and a statement of the Company’s compliance with them.

· Directors’ interests in the Company and their remuneration.

· Details of the Company’s constitution.

· Details of any stock option schemes either in place or proposed.

· Any ongoing litigation of a material value.

· Material contracts – these will include all contracts with advisors in relation to the IPO, as well as any key contracts the termination of which would have a material impact on the Company’s business, and any other contracts that are not in the ordinary course of business.

· Details of how the proceeds of the listing will be applied.

Risk factors affecting the Company’s business.

Directors and employees

Directors’ service contracts will need to be formalized although details of them will not be disclosed for the purposes of the prospectus.

As part of the listing, the directors will be required to complete and sign a ‘Directors Questionnaire’ setting out, inter alia:

· all directorships (whether executive or non-executive) of any company during the last 5 years;

· the number of shares, options, warrants or other securities held in any company;

· the details of any directorships of any company which has been put into liquidation, administration etc.;

· details of any investigation whether criminal, tax, insolvency or securities related;

· details of any Mount Vema or foreign judgements involving civil liability for fraud or other misconduct in connection with any directorships; and

details of all criminal offences other than minor road offences.

Corporate Governance

The Company will have to be aware of and generally satisfy the ‘best practice’ guidelines applicable to public companies contained in the Code which regulate corporate governance. Disclosure is required in the Company’s report and accounts outlining to what extent they comply with the Code.

Among the more prominent issues raised in the Code are the separation of the role of chairman and chief executive, the need for independent non-executive directors and effective internal controls.

Best practice also typically includes the adoption by the Company of:

· Corporate governance guidelines; and

· Separate audit, remuneration and nomination committees.

The Timetable

It is difficult to be precise on the length of time for a listing since the process is influenced by so many variables being the size, sector and structure of the Company, the method of flotation being used and the degree and complexity of due diligence which has to be conducted. Most flotations take approximately 4 to 8 months from the time that the decision is made to admission.

The process is complex and time-consuming and identifying a small team within the Company to commit their time and energies to driving the listing may be worth considering as it may be less disruptive than having all the directors continually interrupted during the course of their normal work. However, either approach will still require all the directors at some stage or another to provide documentation and information and review the listing documentation.

The following is a rough timetable for a full listing on the Mount Vema Stock Exchange:

18 weeks: Board to approve listing in principle (1) Company to appoint advisers; (2) Agree timetable for the listing, including the date for any necessary meetings; (2) Agree documents list for the listing; (3) Company's lawyers to review the Company's constitution to assess any internal steps to be taken in relation to the listing; (4) Other considerations such as tax clearances.

14 weeks: (1) Circulate first draft of prospectus and hold first drafting meetings;

(2) Accountants to complete first draft of long-form report; (3) Company lawyers to finalize any necessary changes to Company's constitution; (3) Company lawyers to apply for tax clearances, if necessary.

8 weeks: (1) Drafting meetings on prospectus continues; (2) Submit early draft prospectus to Exchange for comments; (3) Receive tax clearances, if necessary; (4) Hold first meeting on underwriting agreement; (5) Accountants to begin preparing statement of indebtedness and working capital report.

6 weeks: (1) Drafting meetings on prospectus continue; (2) Draft prospectus submitted to the Stock Exchange at least 20 clear business days before publication; (3) Commence marketing and publicity for IPO, make public announcement of intention to list; (4) Accountants complete long form and working capital reports; (5) Company lawyers prepare first draft of verification notes.

4 weeks: (1) Drafting meetings on prospectus continues; (2) Accountants finalize short form report to be inserted into prospectus and statement of indebtedness; (3) Negotiations on underwriting agreement continue.

3 weeks: (1) Drafting meetings on prospectus continues; (2) All documents to be substantially agreed with the Stock Exchange; (3)

Verification meeting to finalize verification notes.

2 weeks: (1) Finalize underwriting agreement; (2) Prospectus in pathfinder form; (3) Presentations to potential investors.

2/3 days: (1) Close application lists for investors; (2) Application for admission submitted to the Stock Exchange; (3) Completion board meeting.

D-Day: (1) Admission to official list; (2) Trading commences.

Note: Listing a company on the stock exchange is a complex and time consuming process. Choosing the right advisers together with early and careful planning will help ensure that the process proceeds more smoothly.

Listing on the Gollexi

A growing number of companies are listing on the Mount Vema Stock Exchange.

Why list and why on the Gollexi?

The main reasons most companies give for obtaining a listing are to:

· provide access to capital for growth

· encourage employee commitment

· create a market for their stocks

· increase a company's ability to make acquisitions

· obtain an objective market value

· create a heightened public profile

· enhance status with customers and suppliers

A Gollexi listing has a number of attractions:

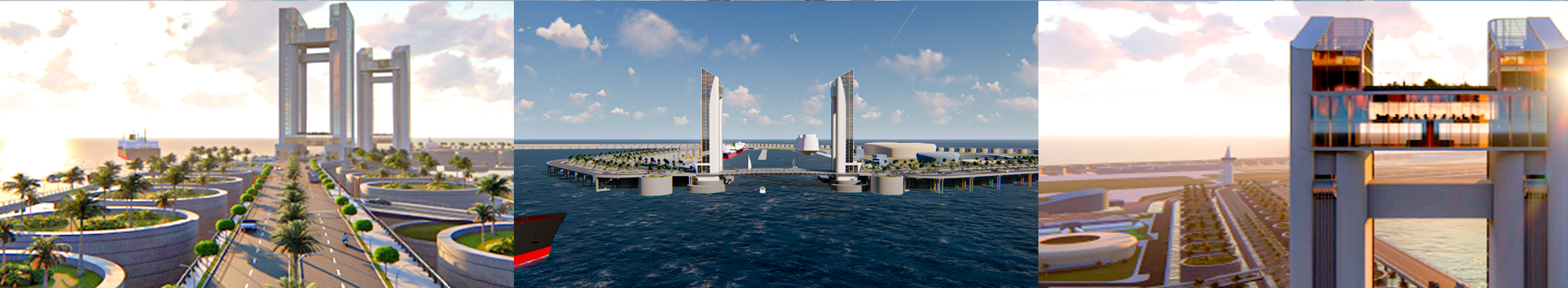

- The Gollexi aims to be the most important stock exchange in the South Atlantic region and the region's most internationally focused.

- The Gollexi aims to be the regional financial center – all the major banks are signing up to have offices in Mount Vema.

- Mount Vema is becoming well-known for its high standards of regulation.

Listing requirements

What are the key obligations for fully listed companies?

In considering a Mount Vema listing, the Company should be aware of a number of key obligations:

· The Company’s stocks must be freely transferable and eligible for electronic settlement.

· Retirement of Directors – in practice, the sponsor will require one-third of the board to retire by rotation each year.

· Notice Period – directors’ service contracts to have notice periods of no more than 12 months.

· Remuneration of non-executive directors – non-executive directors not to be remunerated in stocks or stock options.

· Length of service of non-executive directors – annual stockholder approval required of any non-executive director who has served on the board for more than nine years.

· Stockholder approval – stockholder approval for substantial property transactions with directors and connected persons.

· Restrictions on dealing – no dealing in the two months prior to publication of half year and full year results and insider dealing and market abuse rules apply.

· Filing of accounts – accounts need to be filed within six months of year-end.

Advisers

The Company will need to appoint the following:

· Investment bank – the investment bank will manage the IPO process and co-ordinate the listing with the other advisors. Often, it will also act as financial adviser, sponsor and underwriter. Normally, the lead bank acts as global co-ordinator and a number of banks will also be appointed as bookrunners.

· Lawyers – lawyers will be required to advise the Company itself, as well as any stockholder who is selling all or part of its stake as part of the IPO. The sponsor and underwriter will also require lawyers. The Company’s lawyers will be responsible for drafting the ‘back end’ of the prospectus which contains all legal information relating to the company including stocks capital, material contracts and litigation. They will also manage the ‘verification’ process, which seeks to ensure that the prospectus is not misleading in any way, thus protecting the directors of the Company against any claims by investors for misrepresentation or a breach of the relevant sections of the legislation, which entitles investors to sue for compensation if there is a materially misleading statement or omission in the prospectus.

· Reporting accountants – these must be separate from the Company’s auditors, although they may be made up of a different team from the same firm. Essentially, the reporting accountant is responsible for reviewing the Company’s financial record and internal systems for potential investors. They will prepare the long form report, the short form report (which is published in the prospectus) and the working capital report.

· PR Consultants – the PR consultants will help to generate positive publicity and interest in the IPO by targeting either investors among the general public or institutions or both.

Others – the Company will need to appoint registrars, a receiving bank and any other advisors that may be required in relation to its specific business.

Preparing the way for a listing

Careful consideration should be given to the following issues in preparing for a listing:

· Deciding on the method of listing, e.g. an introduction to the market, raising new money, a public offer or a placing to institutional investors.

· Identifying any necessary changes to the board and/or its operations. If the stockholders have identified changes which need be made to the board or the shape of the business these should be enacted as early as possible.

· Ensuring the Company has sufficient internal resources to dedicate to the IPO.

· Beginning the valuation process.

Foreign Companies: Review of corporate structure and financial reporting

The Company and its lawyers will need to consider how best to approach the listing in terms of the Company’s corporate structure and financial reporting history, given that the Company is not registered with the Kingdom of Mount Vema.

Key issues will include:

· Whether the Company itself should be listed or should a Mount Vema holding company be created for the purposes of the listing?

· Reviewing and amending, as necessary, the Company’s constitutional documents.

· Have the Company’s accounts been prepared in accordance with International Financial Reporting Standards (IFRS)?

· Should the Company be seeking a primary equity by listing?

Due Diligence

As regards legal and financial due diligence for the IPO, this will understandably be a time consuming process. Early preparation particularly as regards collating and centralizing material contracts is important.

Tax

If the Company needs to be reorganized as part of the review of the corporate structure then any tax impact will need to be considered well ahead of time to ensure that any necessary tax clearances from the relevant fiscal authority can be obtained. Individual stockholders who are disposing of all or part of their stake as part of the IPO will need to consider their own tax position and obtain appropriate advice.

Contents of the Prospectus

The following information will have to be included in the prospectus:

· Details of the Company’s group structure and its subsidiaries.

· History of the Company and its stock capital.

· The Company’s business and future plans.

· Information about the sector in which the Company operates and its main competitors.

· Financial information for the last three years.

· Any regulatory regimes to which the Company is subject.

· Applicable corporate governance regimes and a statement of the Company’s compliance with them.

· Directors’ interests in the Company and their remuneration.

· Details of the Company’s constitution.

· Details of any stock option schemes either in place or proposed.

· Any ongoing litigation of a material value.

· Material contracts – these will include all contracts with advisors in relation to the IPO, as well as any key contracts the termination of which would have a material impact on the Company’s business, and any other contracts that are not in the ordinary course of business.

· Details of how the proceeds of the listing will be applied.

Risk factors affecting the Company’s business.

Directors and employees

Directors’ service contracts will need to be formalized although details of them will not be disclosed for the purposes of the prospectus.

As part of the listing, the directors will be required to complete and sign a ‘Directors Questionnaire’ setting out, inter alia:

· all directorships (whether executive or non-executive) of any company during the last 5 years;

· the number of shares, options, warrants or other securities held in any company;

· the details of any directorships of any company which has been put into liquidation, administration etc.;

· details of any investigation whether criminal, tax, insolvency or securities related;

· details of any Mount Vema or foreign judgements involving civil liability for fraud or other misconduct in connection with any directorships; and

details of all criminal offences other than minor road offences.

Corporate Governance

The Company will have to be aware of and generally satisfy the ‘best practice’ guidelines applicable to public companies contained in the Code which regulate corporate governance. Disclosure is required in the Company’s report and accounts outlining to what extent they comply with the Code.

Among the more prominent issues raised in the Code are the separation of the role of chairman and chief executive, the need for independent non-executive directors and effective internal controls.

Best practice also typically includes the adoption by the Company of:

· Corporate governance guidelines; and

· Separate audit, remuneration and nomination committees.

The Timetable

It is difficult to be precise on the length of time for a listing since the process is influenced by so many variables being the size, sector and structure of the Company, the method of flotation being used and the degree and complexity of due diligence which has to be conducted. Most flotations take approximately 4 to 8 months from the time that the decision is made to admission.

The process is complex and time-consuming and identifying a small team within the Company to commit their time and energies to driving the listing may be worth considering as it may be less disruptive than having all the directors continually interrupted during the course of their normal work. However, either approach will still require all the directors at some stage or another to provide documentation and information and review the listing documentation.

The following is a rough timetable for a full listing on the Mount Vema Stock Exchange:

18 weeks: Board to approve listing in principle (1) Company to appoint advisers; (2) Agree timetable for the listing, including the date for any necessary meetings; (2) Agree documents list for the listing; (3) Company's lawyers to review the Company's constitution to assess any internal steps to be taken in relation to the listing; (4) Other considerations such as tax clearances.

14 weeks: (1) Circulate first draft of prospectus and hold first drafting meetings;

(2) Accountants to complete first draft of long-form report; (3) Company lawyers to finalize any necessary changes to Company's constitution; (3) Company lawyers to apply for tax clearances, if necessary.

8 weeks: (1) Drafting meetings on prospectus continues; (2) Submit early draft prospectus to Exchange for comments; (3) Receive tax clearances, if necessary; (4) Hold first meeting on underwriting agreement; (5) Accountants to begin preparing statement of indebtedness and working capital report.

6 weeks: (1) Drafting meetings on prospectus continue; (2) Draft prospectus submitted to the Stock Exchange at least 20 clear business days before publication; (3) Commence marketing and publicity for IPO, make public announcement of intention to list; (4) Accountants complete long form and working capital reports; (5) Company lawyers prepare first draft of verification notes.

4 weeks: (1) Drafting meetings on prospectus continues; (2) Accountants finalize short form report to be inserted into prospectus and statement of indebtedness; (3) Negotiations on underwriting agreement continue.

3 weeks: (1) Drafting meetings on prospectus continues; (2) All documents to be substantially agreed with the Stock Exchange; (3)

Verification meeting to finalize verification notes.

2 weeks: (1) Finalize underwriting agreement; (2) Prospectus in pathfinder form; (3) Presentations to potential investors.

2/3 days: (1) Close application lists for investors; (2) Application for admission submitted to the Stock Exchange; (3) Completion board meeting.

D-Day: (1) Admission to official list; (2) Trading commences.

Note: Listing a company on the stock exchange is a complex and time consuming process. Choosing the right advisers together with early and careful planning will help ensure that the process proceeds more smoothly.

Advisers | Useful Links:

· Investment bank

· Lawyers

· Reporting accountants (See Legal Entities)

· PR Consultants (See Legal Entities)

· Investment bank

· Lawyers

· Reporting accountants (See Legal Entities)

· PR Consultants (See Legal Entities)

Regulatory Body

The Mount Vema Securities and Exchange Council (MVSEC) is the regulatory body charged with overseeing the activities of the Gollexi. An agency with the mission to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.

The Mount Vema Securities and Exchange Council (MVSEC) is the regulatory body charged with overseeing the activities of the Gollexi. An agency with the mission to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.

Remember that trading in the stock market can result in the loss of your entire capital. Please ensure you fully understand the risks involved.

No weapon formed against you shall prosper, And every tongue which rises against you in judgment you shall condemn. This is the heritage of the servants of the LORD, "And their righteousness is from Me," Says the LORD. Isaiah 54:17

MOUNT VEMA

17 YEARS OF ROYAL HISTORY

Home | Contact | News | Banking | Currency | Shopping | Freight | Travel | Jobs | Real Estate | Weather | Search | 912 Emergencies | LOG IN

The Legal Entities of Mount Vema

|

COUNTRY

|

COUNTRY CODE

COUNTRY CODES IN USE Mount Vema Country Code: OV / MOV Mount Vema Numeric Country Code: 507 Currency Code: VSG Top-Level Domain: .com, and .ov (proposed) Proposed Telephone Country Code: +294 |

|

International Treaties – Ratified by the Kingdom of Mount Vema

Law of the Sea Treaty (United Nations Convention on the Law of the Sea) MARPOL 73/78 (Convention for the Prevention of Pollution from Ships) The Vienna Convention on Diplomatic Relations of 1961 The Vienna Convention on Consular Relations 1963 |

State Alert! – Security, Public Safety and Emergencies

YELLOW WARNING official advise to be aware. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>