STOCKS

|

The Gollexi allows companies to raise money by offering stocks (shares). It lets investors participate in the financial achievements of a listed company, making money through the dividend (essentially, cuts of the company's profits) shares pay out and by selling appreciated stocks at a profit, or capital gain. (Of course, the downside is that investors can lose money if the share price falls or depreciates, and the investor has to sell the stocks at a loss.) The index measures the value of stocks and is widely followed as the critical data source used to gage the current state of the Mount Vema economy. As a financial barometer, the Gollexi has become an integral and influential part of decision-making for everyone from the average family to the wealthiest executive and City of Mount Vema Project Participants.

|

Dividends

Dividends are payments made by a corporation to its stockholders, usually as a distribution of profits. When a Mount Vema corporation earns a profit or surplus, the corporation is able to re-invest the profit in the business (called retained earnings) and pay a proportion of the profit as a dividend to stockholders.

Distribution to stockholders are generally made in cash (usually a deposit into a bank account). For each share owned, a declared amount of money is distributed. Thus, if a person owns 100 shares and the cash dividend is 0.50ᴳ per share, the holder of the stock will be paid 50 golles. Dividends paid are not classified as an expense, but rather a deduction of retained earnings. Dividends paid does not show up on an income statement but does appear on the balance sheet.

Dividends are allocated as a fixed amount per stock, with stockholders receiving a dividend in proportion to their stockholding, after tax profits. Retained earnings (profits that have not been distributed as dividends) are shown in the shareholders' equity section on the company's balance sheet – the same as its issued share capital.

Dividends may be paid on fixed schedule on April 28th, August 28th and December 28th as a distribution of profits or surplus, plus a company may also declare a dividend at any time, sometimes called a special dividend to distinguish it from the fixed schedule dividends.

Dividend dates

A dividend that is declared must be approved by a company's board of directors before it is paid. For public companies, four dates are relevant regarding dividends:

Declaration date — the day the board of directors announces its intention to pay a dividend. On that day, a liability is created and the company records that liability on its books; it now owes the money to the stockholders.

In-dividend date — the last day, which is one trading day before the ex-dividend date, where the stock is said to be cum dividend ('with [including] dividend'). In other words, existing holders of the stock and anyone who buys it on this day will receive the dividend, whereas any holders selling the stock lose their right to the dividend. After this date the stock becomes ex dividend.

Ex-dividend date — the day on which shares bought and sold no longer come attached with the right to be paid the most recently declared dividend. This is typically 2 trading days before the record date. This is an important date for any company that has many stockholders, to enable reconciliation of who is entitled to be paid the dividend. Existing holders of the stock will receive the dividend even if they sell the stock on or after that date, whereas anyone who bought the stock will not receive the dividend. It is relatively common for a stock's price to decrease on the ex-dividend date by an amount roughly equal to the dividend paid. This reflects the decrease in the company's assets resulting from the declaration of the dividend.

Book closure date —when a company announces a dividend, it will also announce a date on which the company will ideally temporarily close its books for fresh transfers of stock, which is also usually the record date.

Record date — stockholders registered in the company's record as of the record date will be paid the dividend. Although registration is essentially automatic for shares purchased before the ex-dividend date, stockholders who are not registered as of this date will not receive the dividend.

Payment date — the day on which the dividend is credited to bank accounts.

Tax on dividends

You don’t pay any tax when you get a dividend payment, if you own stocks in a Mount Vema company.

Distribution to stockholders are generally made in cash (usually a deposit into a bank account). For each share owned, a declared amount of money is distributed. Thus, if a person owns 100 shares and the cash dividend is 0.50ᴳ per share, the holder of the stock will be paid 50 golles. Dividends paid are not classified as an expense, but rather a deduction of retained earnings. Dividends paid does not show up on an income statement but does appear on the balance sheet.

Dividends are allocated as a fixed amount per stock, with stockholders receiving a dividend in proportion to their stockholding, after tax profits. Retained earnings (profits that have not been distributed as dividends) are shown in the shareholders' equity section on the company's balance sheet – the same as its issued share capital.

Dividends may be paid on fixed schedule on April 28th, August 28th and December 28th as a distribution of profits or surplus, plus a company may also declare a dividend at any time, sometimes called a special dividend to distinguish it from the fixed schedule dividends.

Dividend dates

A dividend that is declared must be approved by a company's board of directors before it is paid. For public companies, four dates are relevant regarding dividends:

Declaration date — the day the board of directors announces its intention to pay a dividend. On that day, a liability is created and the company records that liability on its books; it now owes the money to the stockholders.

In-dividend date — the last day, which is one trading day before the ex-dividend date, where the stock is said to be cum dividend ('with [including] dividend'). In other words, existing holders of the stock and anyone who buys it on this day will receive the dividend, whereas any holders selling the stock lose their right to the dividend. After this date the stock becomes ex dividend.

Ex-dividend date — the day on which shares bought and sold no longer come attached with the right to be paid the most recently declared dividend. This is typically 2 trading days before the record date. This is an important date for any company that has many stockholders, to enable reconciliation of who is entitled to be paid the dividend. Existing holders of the stock will receive the dividend even if they sell the stock on or after that date, whereas anyone who bought the stock will not receive the dividend. It is relatively common for a stock's price to decrease on the ex-dividend date by an amount roughly equal to the dividend paid. This reflects the decrease in the company's assets resulting from the declaration of the dividend.

Book closure date —when a company announces a dividend, it will also announce a date on which the company will ideally temporarily close its books for fresh transfers of stock, which is also usually the record date.

Record date — stockholders registered in the company's record as of the record date will be paid the dividend. Although registration is essentially automatic for shares purchased before the ex-dividend date, stockholders who are not registered as of this date will not receive the dividend.

Payment date — the day on which the dividend is credited to bank accounts.

Tax on dividends

You don’t pay any tax when you get a dividend payment, if you own stocks in a Mount Vema company.

Regulatory Body

The Mount Vema Securities and Exchange Council (MVSEC) is the regulatory body charged with overseeing the activities of the Gollexi. An agency with the mission to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.

The Mount Vema Securities and Exchange Council (MVSEC) is the regulatory body charged with overseeing the activities of the Gollexi. An agency with the mission to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.

Remember that trading in the stock market can result in the loss of your entire capital. Please ensure you fully understand the risks involved.

No weapon formed against you shall prosper, And every tongue which rises against you in judgment you shall condemn. This is the heritage of the servants of the LORD, "And their righteousness is from Me," Says the LORD. Isaiah 54:17

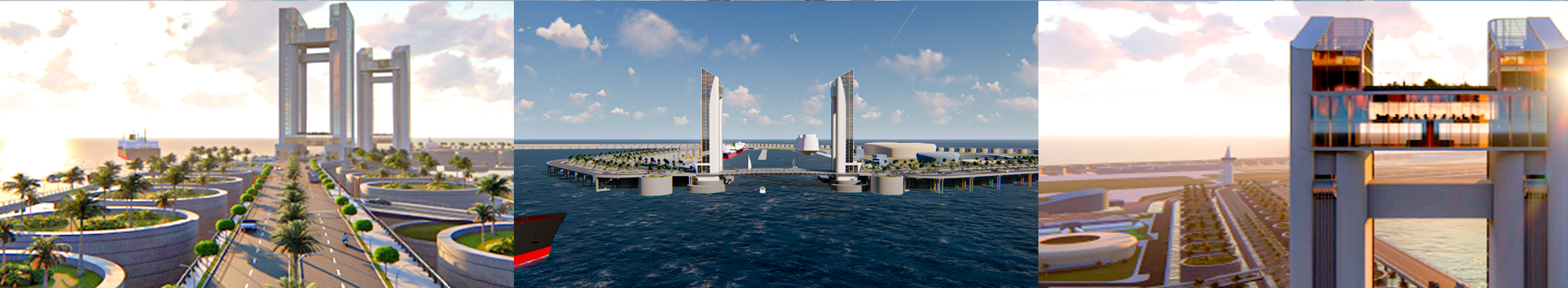

MOUNT VEMA

17 YEARS OF ROYAL HISTORY

Home | Contact | News | Banking | Currency | Shopping | Freight | Travel | Jobs | Real Estate | Weather | Search | 912 Emergencies | LOG IN

The Legal Entities of Mount Vema

|

COUNTRY

|

COUNTRY CODE

COUNTRY CODES IN USE Mount Vema Country Code: OV / MOV Mount Vema Numeric Country Code: 507 Currency Code: VSG Top-Level Domain: .com, and .ov (proposed) Proposed Telephone Country Code: +294 |

|

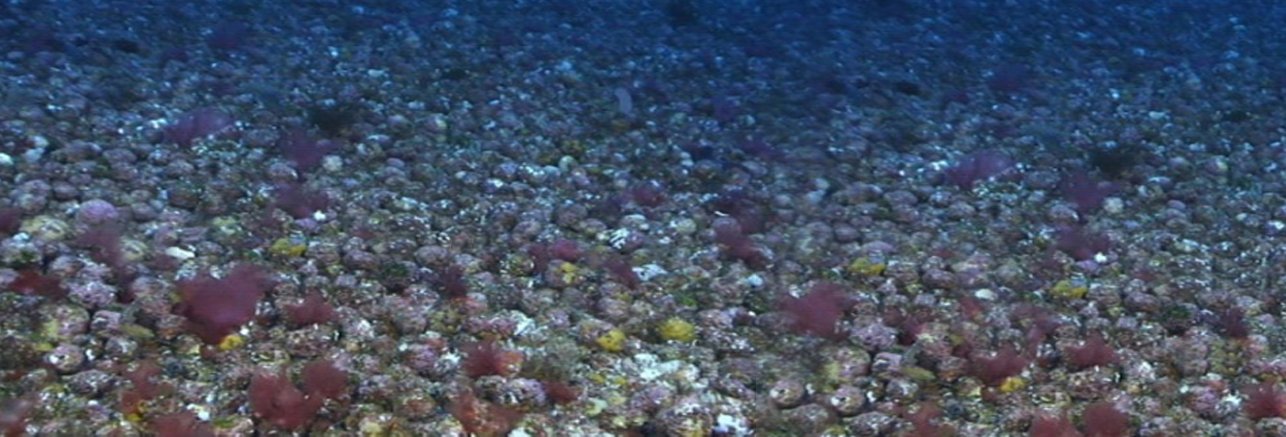

International Treaties – Ratified by the Kingdom of Mount Vema

Law of the Sea Treaty (United Nations Convention on the Law of the Sea) MARPOL 73/78 (Convention for the Prevention of Pollution from Ships) The Vienna Convention on Diplomatic Relations of 1961 The Vienna Convention on Consular Relations 1963 |

State Alert! – Security, Public Safety and Emergencies

YELLOW WARNING official advise to be aware. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>

AMBER WARNING official advise to be prepared. >>>

RED WARNING official advise to take action as instructed by the emergency services. >>>